UI graduates hopeful of new loan forgiveness plan

Some UI graduates are pleased with the promises of President Biden’s new student loan forgiveness plan as they patiently await for cancellations to be reflected on their own student loans.

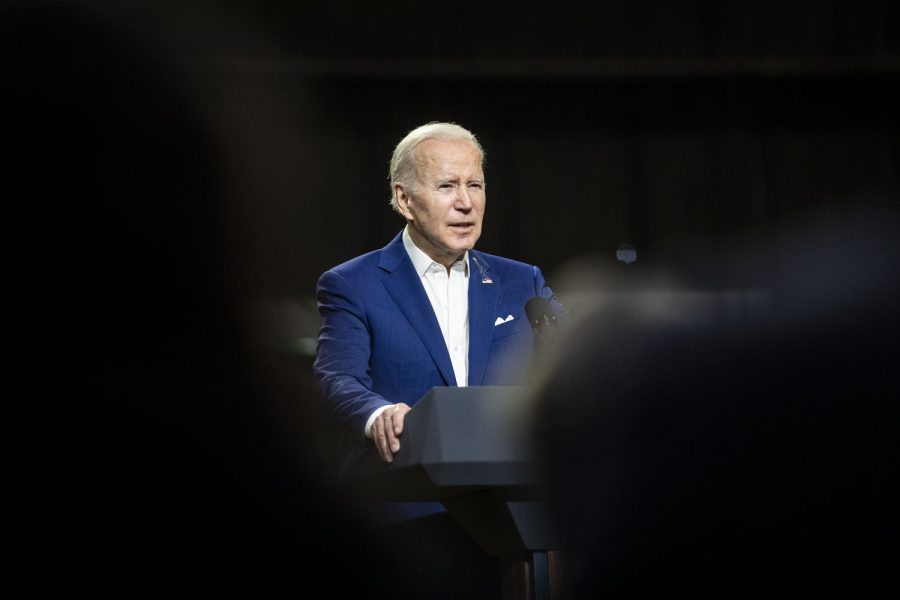

President Joe Biden speaks during a visit at the POET Bioprocessing ethanol plant in Menlo, Iowa, on Tuesday, April 12, 2022.

August 31, 2022

Jake Ryder, a University of Iowa class of 2014 graduate, won’t believe the partial cancellation of his student loans until he sees it go through himself.

Ryder was a Pell Grant recipient, and qualifies for the $20,000 student loan cancellation following the announcement of President Joe Biden’s three-part loan forgiveness plan on Aug. 24.

“The biggest thing that will help me is the adjustments to the income repayment scale,” Ryder said. “I understand where the administration is coming from and what they’re trying to accomplish with this, and I’m one of those people who is fine with making those concessions come tax season to support these kinds of things.”

Ryder said he is happy that the plan will bring immediate loan forgiveness for college graduates.

“I haven’t contacted the school directly, and I haven’t gotten in touch with a loan provider directly either because I assume that there’s probably thousands of other people like me that are probably doing the same thing,” Ryder said.

Some UI graduates, including Ryder, have yet to receive benefits from the plan.

Loan forgiveness is not an automatic process. Those seeking student loan forgiveness will have to apply to the U.S. Department of Education.

RELATED: Here’s what University of Iowa students think about President Biden’s student loan forgiveness plan , Biden’s new student loan plan will forgive up to $20,000 in debt

Aside from the occasional check of his status on his student loan website, Ryder said he has yet to take any further action on the plan amidst the loan repayment frenzy, and that he has reserved most of his excitement for when the relief actually comes.

The U.S. federal student loan debt currently totals at over $1.6 trillion, owed by about 43 million borrowers.

Steve Schmadeke, a UI public relations specialist, wrote in an email to The Daily Iowan that questions about loan cancellations are being addressed on a case-by-case basis.

The UI Office of Student Financial Aid provided a resource page guiding UI alumni toward the correct resources to help them make use of the plan, and noted that student debt is not owed to the university itself.

Three years after graduating, 2.2 percent of UI graduates fail to pay their student loans, according to the state Board of Regents 2022 financial aid report.

Gabrielle Aranza, a UI class of 2022 graduate, said she felt her student debt has financially restricted her from branching out into the real world after graduation.

“Now with the new debt relief, I feel like I can make those next steps sooner in my life. I feel like this is just so important because a lot of young people can’t hit those milestones like moving out of their parent’s house and buying a house,” Aranza said. “I feel like it’s just super important for young people for them to move forward.”