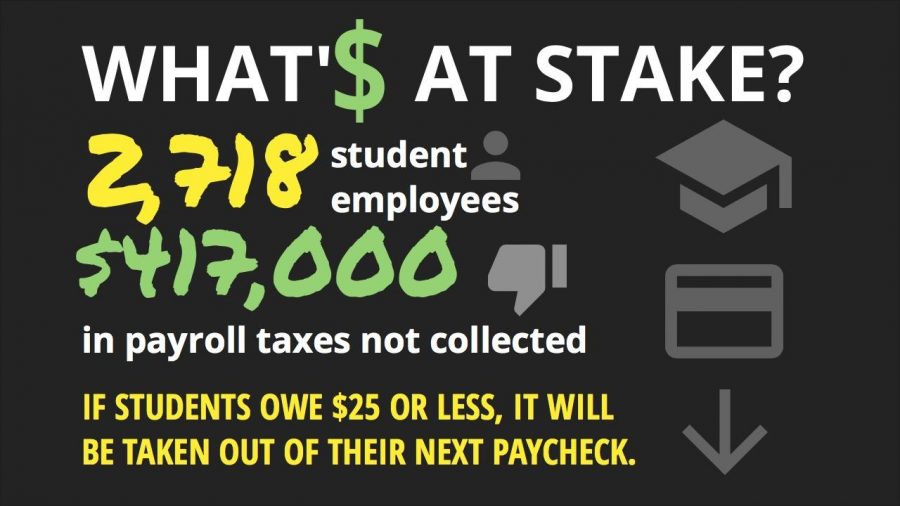

A tax error on summer student employees’ paychecks means lower paychecks until the shortage is made up.

Approximately 2,800 student employees did not have the correct amount of tax taken out of their paychecks during the spring and summer, said Daniel Schropp, the director of University Payroll Operations. The amount of money needed to be collect in taxes, he said, totals to around $417,000.

The error, Schropp said, was found to be a technical miscalculation issue. The error was found, he said, while working on the yearly audit.

Federal law requires the missing tax money to be collected, he said.

An email from the University Payroll Services was sent to the affected students once the error was found, informing them the correct amount of FICA taxes, which include Social Security and Medicare, had not been taken out.

The email said the amount each student owed had been calculated and would be taken out of their paychecks accordingly. Depending on the individual case, the email said, the money would be taken out from the next three monthly paychecks or the next six biweekly paychecks. If students owed $25 or less, the email said, the full amount would be taken from their next check.

Schropp said if a student was employed with the UI when this error occurred and no longer holds a job here, the employee has been contacted to set up an individual payment plan.

RELATED: UI student wages to rise

“We understand that students have limited budgets,” the email said. “And the UI will remain flexible and sensitive to individual student needs.”

UI sophomore Genevieve Cleverley, one of the student employees affected, said she worked at Hancher over the summer and was emailed a few days ago about a paycheck deduction to make up the tax money.

In addition to working at Hancher, she said, she has another job off-campus, so a smaller paycheck until the UI collects the tax money isn’t the end of the world. However, after working hard to earn her paycheck, Cleverley said she finds the situation annoying. She also said she feels for those who rely on their university paychecks.

“It’s a bummer [students] have to work so hard and so much just to live,” Cleverley said.

Resources exist for students who feel they will not be able to get by without their full paychecks, Schropp said. The UI Office of Financial Aid, he said, provides one-on-one financial literacy services to help students figure how to budget their funds. Schropp said there also is a student emergency fund offered by the dean of students, if a student meets the qualifications for it.

Measures to ensure this issue does not occur again have already been implemented, Schropp said, like notifications for those at University Payroll Operations to see if something looks amiss.

The UI is hoping to have all missing tax money collected by the end of the tax year, Schropp said.