Opinion | Why the President Biden debt relief plan will create more problems

Income-driven repayment plans incentivize colleges to increase tuition prices and students to borrow the maximum amount.

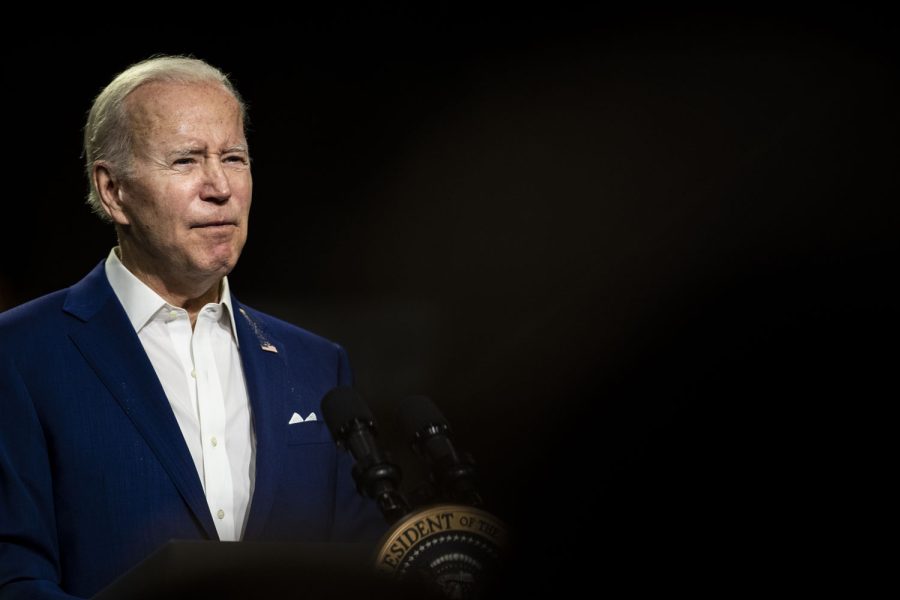

President Joe Biden reacts during his visit at the POET Bioprocessing ethanol plant in Menlo, Iowa, on Tuesday, April 12, 2022.

September 11, 2022

The structure of student loan repayments will be unstable in the near future.

When President Joe Biden canceled student debt for millions of Americans, liberals and progressives celebrated the order arguing it would help Americans who need it the most. Naturally, conservatives made the same half-baked argument about personal responsibility.

Lost in the fray were the changes Biden’s student loan relief order made to income-driven repayment plans. These specific changes will drive up the cost of higher education for college students.

When a recent college graduate begins paying out their student loans, they use an income-driven repayment plan to schedule their loan payments. Student debtors pay off their loans via a percentage of their income over 20 years. After the 20-year period, whatever was not paid off is forgiven by the government.

The popularity of an income-driven repayment plan also increased in the previous decade from 10 percent to nearly 32 percent. All signs point to the fact that in subsequent years, the program is going to become the dominant repayment plan for student debtors.

In the past, if a debtor was enrolled in an income-driven repayment plan, 10 percent of their income was siphoned off to repayment. The Biden-Harris Administration cut the percentage down to 5 percent and mandated that no interest be accrued on the loan.

Furthermore, for people who had loan balances under $12,000 their repayment period was reduced to 10 years. If a debtor is making under 225 percent of the federal poverty line, they do not have to repay their loans.

Income-driven repayment plans make change the demand for college student’s becomes more inelastic.

To put this into simpler terms, even if the average price of college were to increase by 10-fold, consumers would still choose to go to college because repaying loans has never been cheaper or easier. Even if the debt is not paid off by the end of the income-driven repayment plan period, it is canceled without repercussion.

Essentially, the economic intuition is that when people will still buy a good or service no matter the price of that good, suppliers have every incentive to raise the price of that good. In the case of paying for college, income-driven repayment plans make it so that college administrators and state lawmakers could dramatically increase the price and students would still go to college.

The repercussions of this phenomena would be that it would create a credit bubble that could potentially swell to an astronomical size. When the government must start forgiving those loans, that bubble will eventually burst.

When that bubble bursts, the economy will go with it as trillions of dollars will be lost. This is because a bubble burst causes a chain reaction that will inevitably force all people (not just debtors) to cut back on their spending which will in turn plunge the economy into a recession.

In other words, the changes made to the plans by the Biden-Harris Administration could unintentionally cause the formation of a dangerous credit bubble that would lead to economic calamity.

So, what could possibly be done to prevent a credit bubble from forming?

The answer is simple: the federal government must begin to regulate the costs of college, Otherwise, millions will lose everything once the credit bubble inevitably bursts.

Columns reflect the opinions of the authors and are not necessarily those of the Editorial Board, The Daily Iowan, or other organizations in which the author may be involved.