Though some cities in Iowa may be feeling their budgets tighten as a result of property-tax problems, Iowa City does not feel the heat.

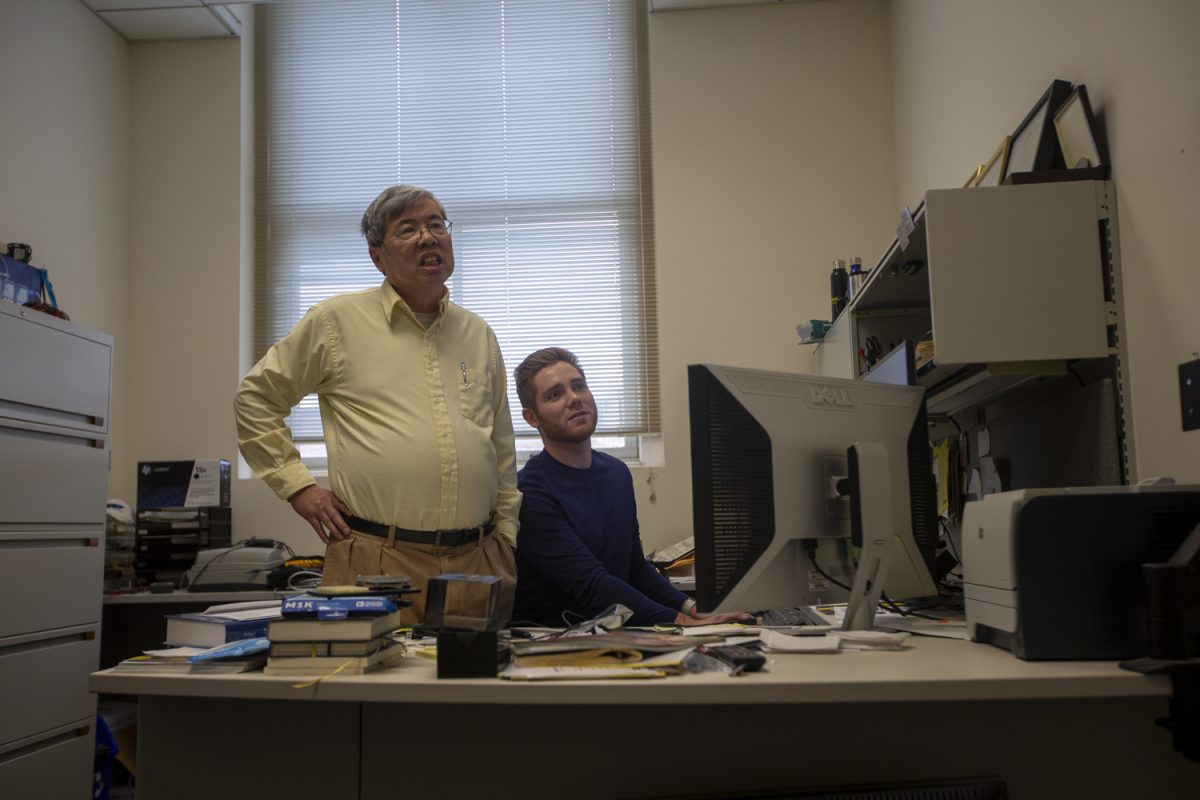

Simon Andrew, the assistant to the Iowa City city manager, said state legislation was passed in 2013 reducing the property-tax value on commercial properties, changing the taxable amount on a business’s property.

“Instead of being taxed 100 percent of their assessed value, they’re taxed at 90 percent of [the property’s] value,” he said.

The state must make up the loss of property-tax funds in the form of backfill payments. When Iowa does not do this, Andrew said, it results in budget issues and huge losses to cities.

Even if other cities may be frustrated by not receiving full backfill money, he said, Iowa City has received all of these payments, totaling $1.5 million.

The backfill money is put into Iowa City’s general fund, Andrew said, which takes care of city measures such as hiring and providing benefits to those in the Police and Fire Departments. These payments make up two-thirds of the general fund.

City Finance Director Dennis Bockenstedt said the city’s operating budget is around $130 million. So, he said, the backfill payments are just over 1 percent of the Iowa City operating revenue.

The general fund, which backfill payments go into, is the primary source of the operating fund, he said. The general fund totals $56 million, he said, which is 43 percent of the operating cost.

If these backfill payments were taken away, Bockenstedt said, the city may have to use such measures as increasing the property-tax rate, cutting services, or increasing costs of services.

UI junior Johanna Chambers said she sees any increasing costs in a town crawling with college students would be detrimental; people would have to stop spending money, she said.

“I’m already a broke college kid who can’t afford things,” she said.

Bockenstedt said looking into how the problem should be solved would take time.

“Prioritizing [items in the budget] is the best way to deal with this,” he said. “But that can’t be determined until we have a need to do so.”

Andrew said Iowa City is prepared in the event backfill payments are phased out or taken away; he said the city has been good at planning.

An emergency fund has been in place for several years to make up for backfill payment losses should the city need to use it, Andrew said. The fund will smooth out any negative effects backfill payment losses could cause, at least for the short-term while the city decides on further moves.

Iowa City has been reducing tax rates for six years, Andrew said, which would help with potential backfill losses. New hotels and motels under construction in the city would also help in this situation, he said.

While Iowa City has not had to directly deal with any of the issues yet, Andrew said, it monitors the property-tax situation and is concerned about the potential loss of backfill payments.

While this concern exists, Andrew said, Iowa City is in a good place and prepared to cushion any negative effects if these issues arise.