Though the future of wind energy in the United States may be unclear, Iowa lawmakers believe an extension on the credit is crucial for the production of wind energy in the state.

The federal Renewable Electricity Production Tax Credit was first created by Congress in 1992. The program gives a tax credit to energy produced by wind, as well as other renewable electricity sources. The credit was extended for one year on Jan. 1, meaning it would expire at the end of the year if not extended further.

Harold Prior, the executive director of the Iowa Wind Energy Association, said the program needs to be extended because without it, the marketplace would be unfair. Currently, he said, the government subsidizes energy production by other means, such as gas.

“If you’re going to subsidize energy, why wouldn’t you subsidize all energy,” he said. “They need to provide this … so that we do have a level playing field.”

Sen. Chuck Grassley, R-Iowa, agrees the tax credit should be extended, because wind energy is a valuable resource in Iowa.

“Wind energy is a free resource, and it’s abundant in places around the country, including Iowa,” Grassley said in a newsletter. “Wind energy will stand up next to any other form of energy when given a fair shake.”

Iowa is one of the leading producers of wind energy, Prior said, and extension of the tax credit will help further access to this resource.

“Iowa has tremendous future potential for expanding wind energy,” Prior said. “Right now, we’ve only tapped 1 percent of that resource.”

But not all legislators feel the same way.

Rep. Mike Pompeo, R-Kansas, said the tax credit shouldn’t be extended because it gives an unfair advantage to wind energy.

“The government should not use tax dollars to prop up specific energy sources in the market,” he said in a statement. “Do not pick winners or losers; government must not favor one energy sector over another.”

Pompeo favors ending all federal energy subsidies, which is a different way of creating the “level playing field.”

Sen. Tom Harkin, D-Iowa, said alternative energy is important for the national economy, and Iowa is key.

“Transitioning to more energy efficient and environmentally friendly technologies is critical for the future of the U.S. economy,” he said in a statement. “Iowa has been a leader in that transition, with wind power playing a key role in that transformation.”

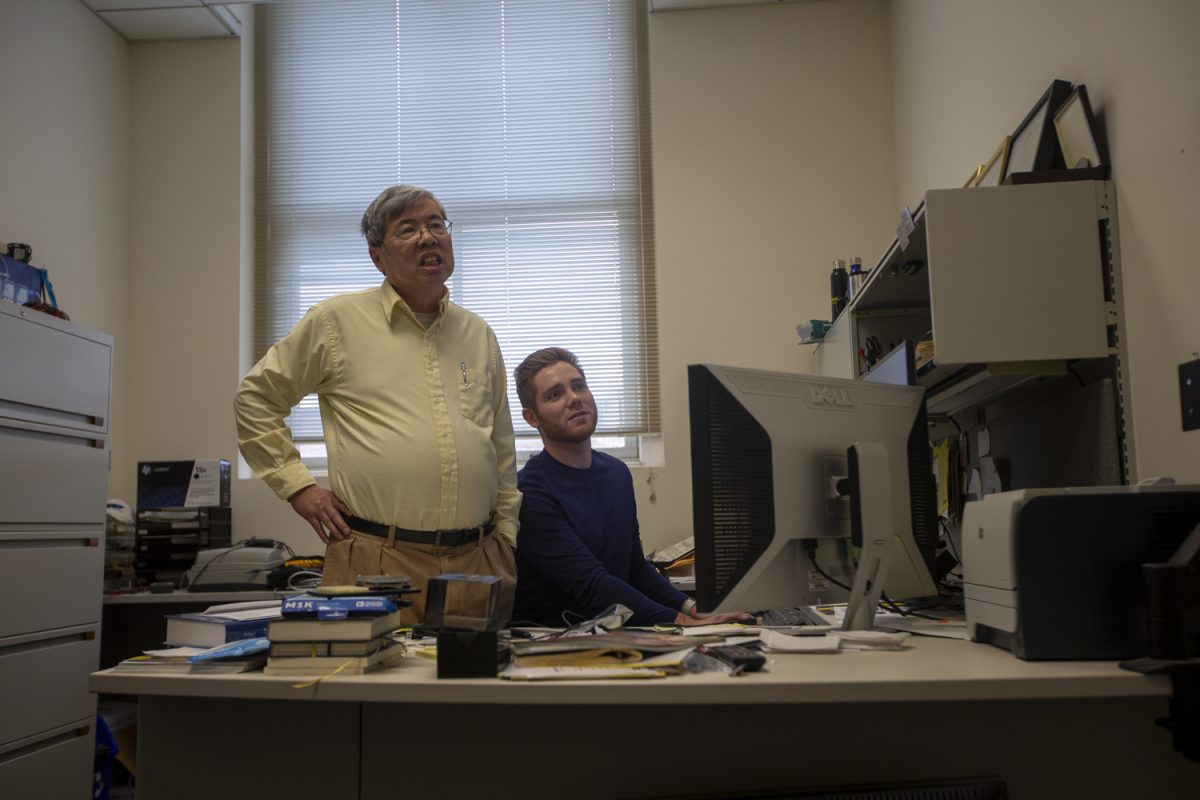

University of Iowa political-science Associate Professor Timothy Hagle said it is unclear whether the tax credit will be renewed, because there are several factors that could influence it.

“Congress is going to have a number of things on their plate [between now and the end of the year],” he said, which may cause some things to be pushed to the side.

However, Hagle said, there is hope for the program because of stagnation in Congress. “Because things aren’t moving … there’s a potential that sort of smaller pieces of legislation might have a chance to go through,” he said.

Both Harkin and Grassley are pushing for an extension of the tax credit, but the future is still unclear.

“The progress has not been all that it could be because of uncertainty and delays in extending the [tax credit],” Harkin said in a statement. “I have urged a long-term or even indefinite extension of the [tax credit] — 10 years at the least.”