The Iowa City Planning and Zoning Commission will discuss restricting where payday lenders may open outlets in the city after the Iowa City City Council approved discussions in March.

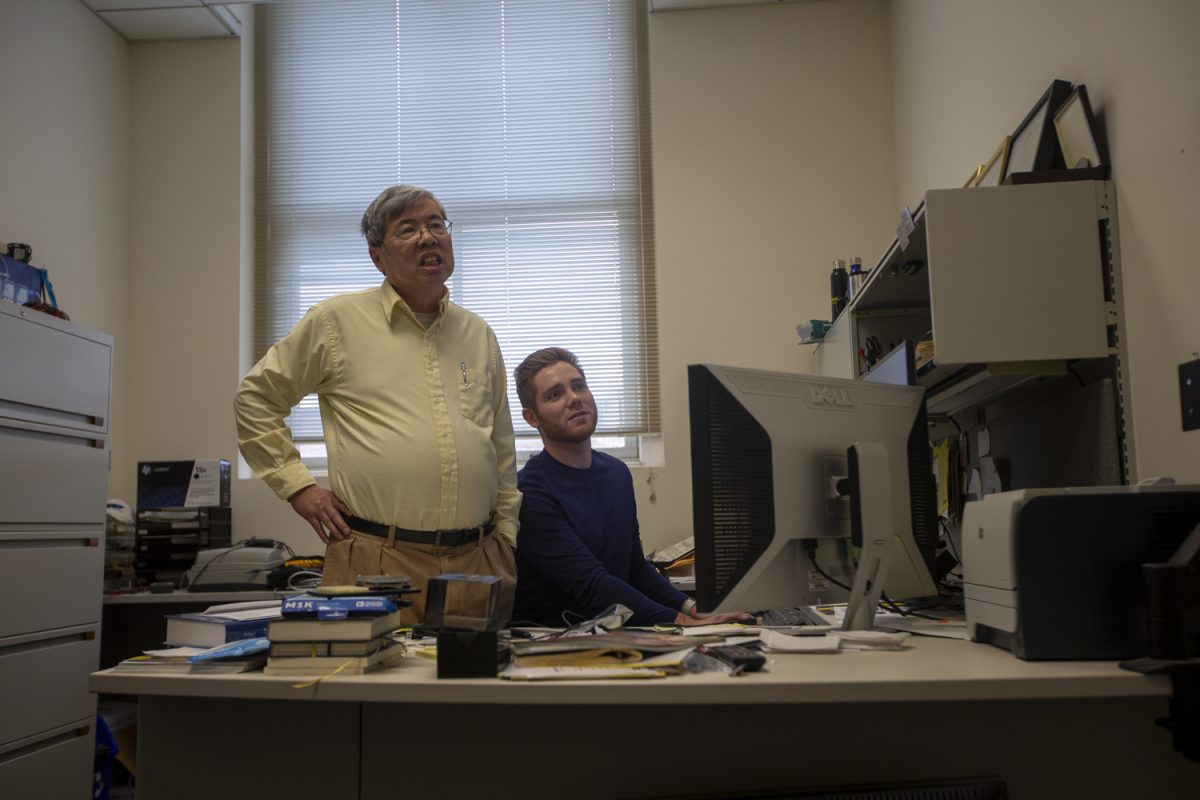

Senior city planner Robert Miklo said the commission is interested in regulating payday-lending operations after studies showed their potential negative effects on surrounding neighborhoods. The Planning and Zoning Commission will discuss a possible ordinance at 7 p.m. Thursday.

Payday lenders offer short-term loans to people between paychecks, charging high interest rates in return.

"They tend to be associated with high-crime areas and loitering, therefore having a negative effect on surrounding neighborhoods," Miklo said.

He said Iowa City has not seen these effects, but the ordinance is intended to be a preventative measure.

Iowa City staff recommended zoning restructuring to force new payday lenders to build in community commercial zones, require a minimum of 1,000 feet between these operations, and separation from areas that may be negatively affected, and only allowing lenders licensed by the state of Iowa to build in the city limits, according to the report.

David Goodner, a community organizer with Iowa Citizens for Community Improvement, requested that the City Council regulate payday lenders in February.

City Councilor Rick Dobyns said he does not have an opinion on payday lenders yet, but he is interested in learning more from Iowa City citizens and city councilors.

"I think it’s a difficult situation to know the various options," he said. "If they can’t be in the city at all, or separated by geographic distance, pushing them out to other areas of the city. I think we have to weigh those options."

Dobyns said there are pros and cons with these lending operations, but he is interested in discussing a possible ordinance after similar legislation has been passed in other Iowa communities.

Miklo said officials researched similar ordinances in Des Moines, West Des Moines, Clive, and Ames.

According to a consumer-advisory bulletin from Iowa Attorney General Tom Miller, almost half of state payday loan borrowers borrow more than 12 payday loans a year.

"Leading to an average of $480 spent on borrowing fees alone per year," he said in the bulletin. "Those dollars are down the drain."

Nick Leyden, local associate financial adviser at Amerprise Financial, said he advises his clients against payday loans because of the astronomical interest rates.

"If people don’t have the money to do their daily life or if some extravagant event comes up and they don’t have the money to pay for it, they’ll borrow money at these payday-loan places," he said. "What they offer is a huge interest rate on top but promise to cash the check one or two weeks out. The huge problem with that is how much you are paying in interest to get that money."

Leyden said he advises consumers to live within their means, and retain a cash reserve to cover three to six months of living expenses.

City Councilor Connie Champion agreed that payday lenders make it too easy for people to borrow money, but said she is not sure how they should be regulated in Iowa City.

"Limiting them is fine, but the only thing that bothers me is it gives the people that are already out there a monopoly," she said. "Ones that are already there will benefit from this. Getting more business, I don’t know. Not less business, but not more competition."