University of Iowa and White House officials stressed the importance of bipartisan support for student loans and college affordability in light of President Obama’s visit to campus today.

Obama will speak to students about the need for Congress to act on extending legislation on interest rates for student loans.

"I want to talk to students right now about how we can make college education more affordable," Obama said on Tuesday in a conference call for student journalists. "If Congress doesn’t act on July 1, interest rates on some student loans will double."

Obama will address UI faculty, staff, and students in the Field House around 1 p.m. The UI is the president’s last stop on a two-day campus tour that also included Tuesday visits to the University of North Carolina-Chapel Hill and the University of Colorado-Boulder.

Legislation passed in 2007 to keep interest rates for federal student loans at 3.4 percent is set to expire July 1. Those interest rates will double to 6.8 percent if Congress doesn’t act to extend the loan cut for another year.

Mark Warner, the director of UI Student Financial Aid, said increased interest rates may result in some students having to extend their repayment periods.

"This will affect not only the dollar amounts of monthly payments students will have after graduation, but it will also mean that the student is paying back more money overall," Warner wrote in an email.

He said 53 percent of UI undergraduate students received loans during the 2010-11 school year. Federal Direct Student Loans represented roughly 93 percent of those loans.

Obama said he wants to talk to college students directly about the "critical importance" of federal student-loan interest rates doubling. Roughly 7.4 million students with federal loans would be affected, he said.

"[Higher education] has never been more important," he said. "It’s also never been more expensive."

"Republicans in Congress have voted against new ways to make college more affordable for middle-class families and voted for huge new tax cuts for millionaires and billionaires — tax cuts that would have to be paid for by cutting things like education and job-training programs that give students new opportunities to work and succeed," he said.

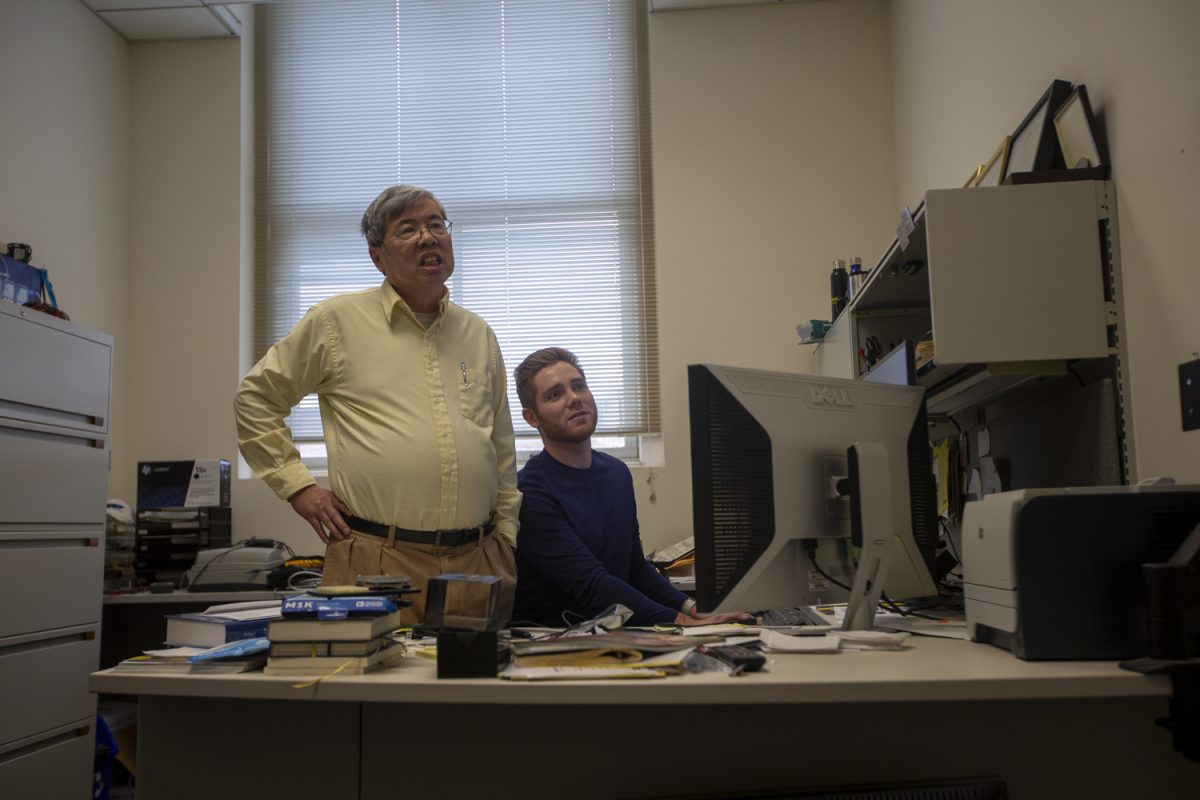

One UI political-science professor said Republicans also favor lower interest rates but are worried they would add to the national deficit.

"If you’re looking at the bigger picture, [extending loan interest rates] is not solving the debt and the deficit," said Tim Hagle, a UI associate professor of political science. "Some of the Republicans in Congress are concerned that it will be an additional $6 billion that the government will spend over time."

However, one White House official said there’s no reason there shouldn’t be bipartisan support for Obama’s proposal.

"This is something Congress took care of in a bipartisan way in 2007," said Cecilia Muñoz, an assistant to the president. "… This is the kind of thing that can get done in a bipartisan way. Washington can be a difficult place. There are roadblocks in the Congress often where they shouldn’t be. [We need to] clear a path for bipartisan action."