University of Iowa students will likely see more federal money under massive changes to a national student-aid program passed late Sunday by the U.S. House of Representatives.

Under the new plan, Pell Grant funding will increase and the federal government will take more control of student loans from private lenders. The changes were passed in conjunction with health-insurance reform.

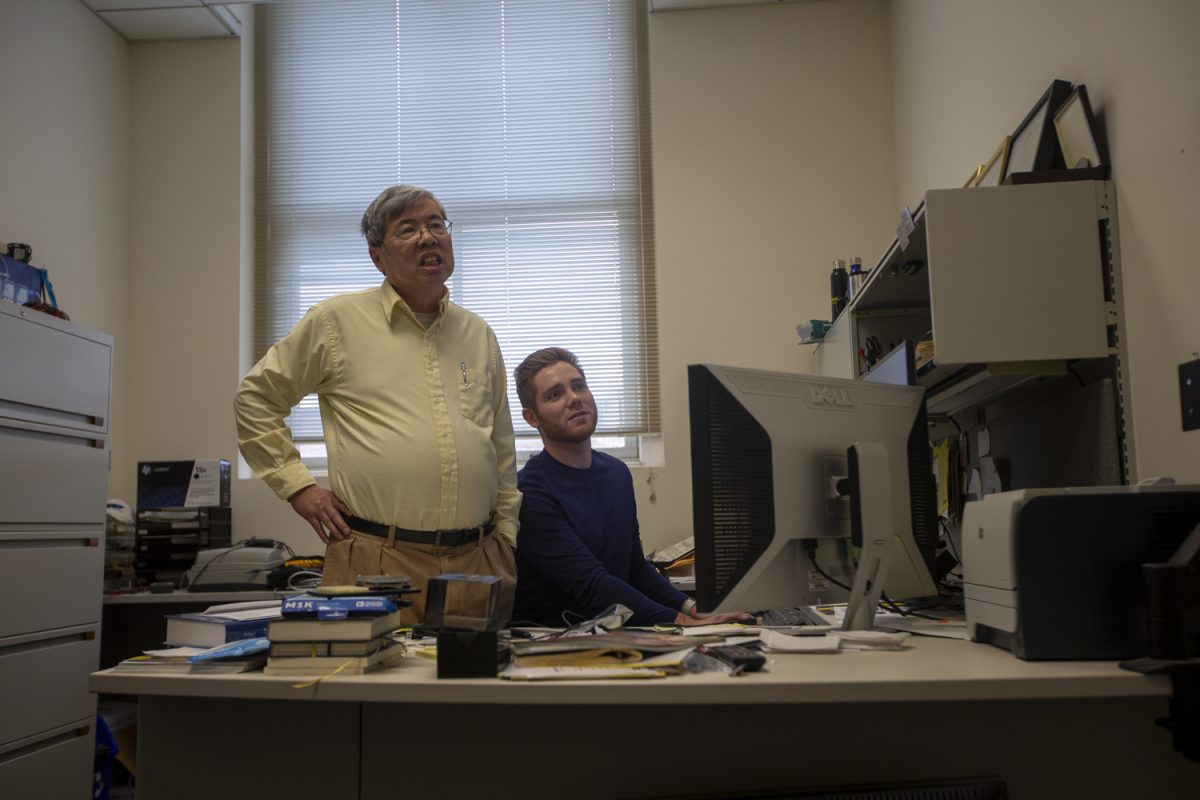

Mark Warner, the director of UI Office of Student Financial Aid, said he hopes to see more students qualify for financial assistance.

The UI is already part of the federal Direct Student Loans Program, Warner said. The biggest change will be more Pell Grants for UI students — the new legislation invests nearly $36 billion more in the need-based program.

“The only change for us is students getting more aid,” he said.

For the 2009-10 school year, 3,671 undergraduate students — around 19 percent of the UI’s undergraduate population — received Pell Grants. On average, recipients at the UI received $3,618.

Under the new law, private student loan companies will be required to offer low-interest loans. Government subsidies will keep rates down, when necessary.

Streamlining all student loans through the government will “eliminate unwarranted subsidies to banks in the federal student-loan programs,” according to a statement from Rep. George Miller, D-Calif., who wrote the legislation.

UI junior Stephen Biermann said the change could make it simpler for students who apply for aid.

“If the loans coming from just one place can generate more available funds, I’m all for it,” he said. “Applying for loans and paying for school is really scary, and people worry about it a lot.”

The maximum award for the Pell Grant is $5,350. Next year, that number will rise to $5,550 and increase to nearly $6,000 in coming years.

Regent Robert Downer said he thinks the new proposal appears to cut costs and will make more money available.

“I think the program has some good intentions, and I believe it can potentially be positive for all students applying for aid,” he said.

UI President Sally Mason also said she feels strongly about ensuring students can afford their education.

“Education is too important in this environment right now to opt out,” she told the DI earlier this month. “So the worst thing is for students, because of financial constraints, to forgo their college education.”

Gregory Cendana, the president of the United States Student Association, said he believes action by the federal government on student loan reform has been “sorely needed for too long,” noting two-thirds of college students face an average of $25,000 of college debt.

The bill is being considered by the Senate, in which it needs a simple majority vote to pass.