Despite smaller tuition and fees, more resident students are graduating with debt than nonresidents.

University of Iowa sophomore Marie Hafner grew up in Bettendorf always knowing exactly where she wanted to attend college.

Hafner could imagine herself in the UI’s psychology and pre-medicine programs and even attending graduate school here.

One remaining question, however, was how exactly she would pay.

Because her father was an accountant, she said, she understood the financial burden college would place on her family. Still, she saw college expenses as a hurdle she inevitably would have to climb in order to fulfill her dream of becoming psychiatrist.

“It feels like you have to borrow so you can get the job you want and so you can pay the loans off,” Hafner said.

Hafner is an Iowa resident, an Honors student, and an Old Gold Scholarship winner — an institutional scholarship valued at $5,000 per year.

In addition to her scholarship, Hafner borrows about $7,000 in federal student loans per year. Her parents borrow $11,000 for her each school year, also through a federal loan, which she said they expect she’ll pay back one day.

She mostly thinks about her loans, she said, when it’s “FAFSA time” and in the summer when she’s trying to pay off interest her loans accumulated.

“I have quite a while to go, but [graduate school] is going to cost even more,” Hafner said. “I haven’t necessarily thought that far ahead.

Though Hafner’s $8,000 per year resident tuition and fees may look small beside $26,000 nonresident tuition, she isn’t the only resident accumulating debt.

About 70 percent of UI resident students graduated with debt in the 2013-2014 school year, according to the most recent state Board of Regents’ financial aid report. Significantly fewer nonresident students, about 50 percent, had loans to pay back after graduating.

The UI had about 55 percent resident and 45 percent non-resident students in the fall of 2014, according to their admissions website.

UI Director of Student Financial Aid Mark Warner said the main reason for the disparity could be the lack of a significant state grant program for Iowans attending public colleges.

Students enrolled in Iowa’s private colleges and universities received about 80 percent of need-based grants provided by the state in 2012-2013, according to the National Association of State Student Grant and Aid Programs.

“There is no state grant program specific to student attending Iowa public universities,” Warner said.

The remaining 20 percent of state need-based grants don’t only go to other public universities but also Iowa’s community colleges.

“At the end of the day, our students get very little state grant money,” he said.

Warner noted several other factors at play such as cost of attendance, if a student lives on or off campus and need versus choice spending.

A big factor, Warner said, is median household income. With a lower family income, students are more likely to need loans.

“If a larger percentage of our nonresident students are coming from families with higher incomes, then they may not be so inclined to borrow as opposed to those of lesser incomes,” he said.

Roberta Johnson, director of Iowa State University’s Student Financial Aid Office, also pointed out that state granting programs aren’t extremely “robust.”

“Generally, what we find is the people who send their students out of state aren’t borrowing at the same rate,” she said. “We have a substantial number of students from out of state who are sufficiently resourced.”

She said that, though out-of-state students provide extra funds through higher tuition that could be used toward other areas of the institution, their first priority is citizens of the state.

The University of Northern Iowa, though also a regent institution, has about 90 percent resident students.

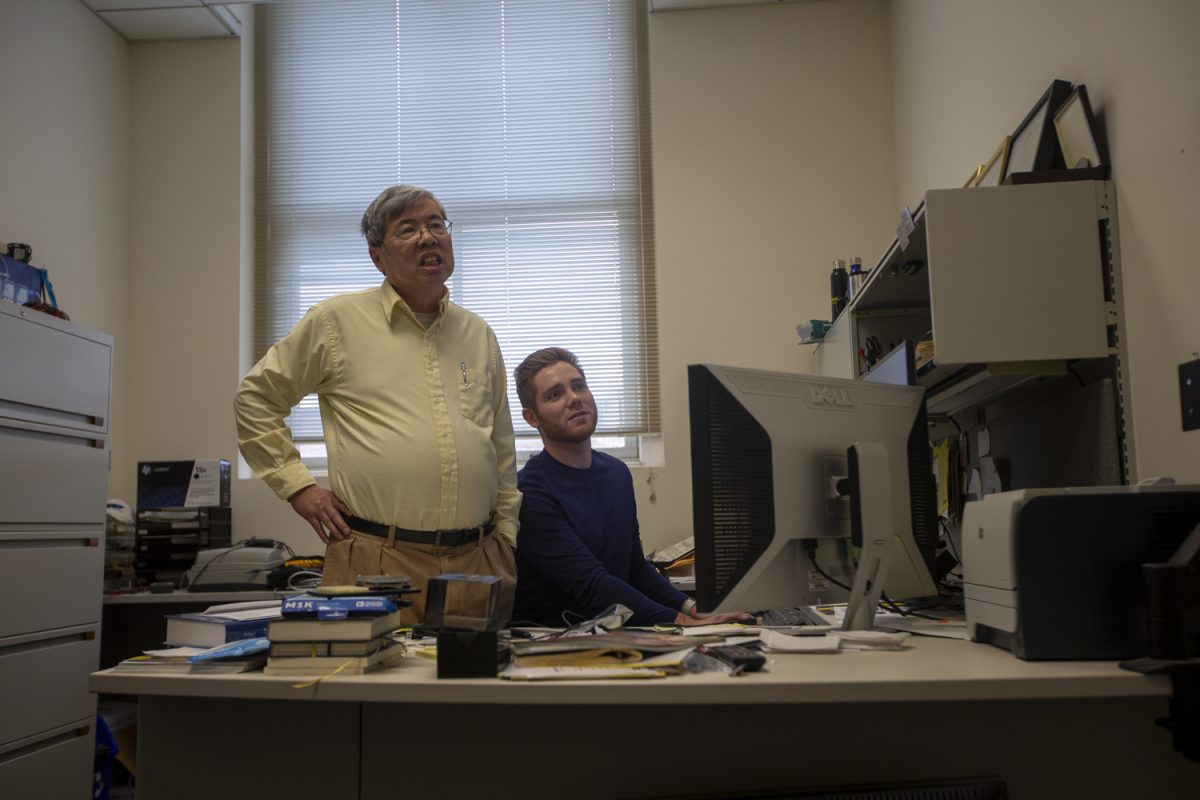

The UI hired two financial literacy specialists in July 2014, Warner said.

They’ve advised almost 1,700 students so far, according to UI records. Of the students who visited, 30 percent chose to reduce their original loan requests by an average of 36 percent.

The average loan reduction request was about $5,500.

“Generally speaking, I think there’s a perception that everyone who comes here as a nonresident student is coming from a super wealthy family and that they come from the suburbs of Chicago,” Warner said. “It’s not true. We have students coming from low incomes from all over the country.”