As the U.S. Supreme Court debates national health-care reform, Iowa — including Johnson County — has maintained one of the lowest percentages of uninsured residents in the country.

According to a 2012 County Health Rankings and Roadmaps report, 10 percent of Iowans lack health insurance, with 9 percent of Johnson County residents uninsured. The 2011 Gallup-Healthways Well-Being Index found an average of 17 percent of Americans without health insurance nationwide, placing Iowa ninth in states with the lowest number of uninsured residents.

One local expert said these numbers aren’t shocking.

"[Johnson County] not only draws from being a very educated place to live but also has lower unemployment, so if people are employed, they may have group benefits," said John Raley, an insurance agent for American Family Insurance. "That’s a big factor in our particular county."

Most students at the University of Iowa default to their parents’ health-insurance plans, but some sign on to the UI’s Student Health Insurance Plan.

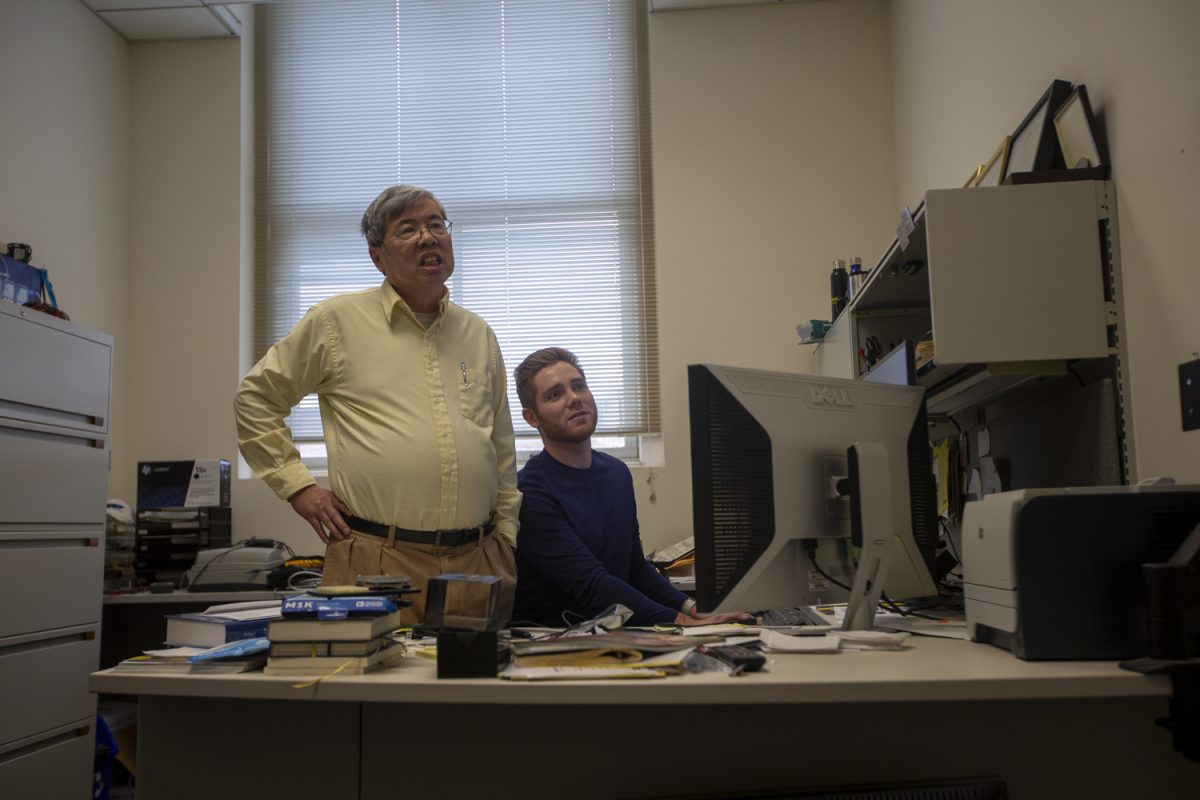

"Most of the students, if they had family coverage available, would be under [their parents’ plan] from the cost perspective," said Richard Saunders, a UI assistant vice president for Human Resources.

Roughly 3,500 students have the Student Health Insurance Plan, and roughly 2,500 graduate students have UI GRADCare.

These insurance plans can cost a student between $120 and $211 per month, Saunders said.

Obama’s Affordable Care Act will require Americans in 2014 to obtain health insurance through an employer or government program or by their own means. The Supreme Court is currently discussing whether it is Constitutional to mandate insurance coverage for every U.S. citizen or expand eligibility for Medicaid benefits.

Raley said the company closed its market to those seeking health insurance in May 2009, roughly a year before the Patient Protection and Affordable Care Act was signed into law March 23, 2010.

"When Obama came out with this thing, it was too risky to have something be mandated," he said. "We couldn’t afford to stay in not knowing what the rules were going to be or if we could accept everyone. … That’s too big of a risk for us to take."

However, Raley said the health-care issue — locally and nationally — is about more than just health insurance.

Doug Beardsley, the director of Johnson County Public Health, said Johnson County’s rate of uninsured residents is favorable but still has room for improvement.

"It’s always preferable that everyone have access to some base level of care," he said. "Nine percent is good, but we could still improve."

While the Supreme Court continues to debate the constitutionality of the Affordable Care Act, Raley said Americans will continue to purchase health insurance so long as it remains affordable.

"I don’t think anybody wants to go without insurance, but when it comes to be where the insurance is going to take food off their table … they’re going to prioritize those things first," Raley said.