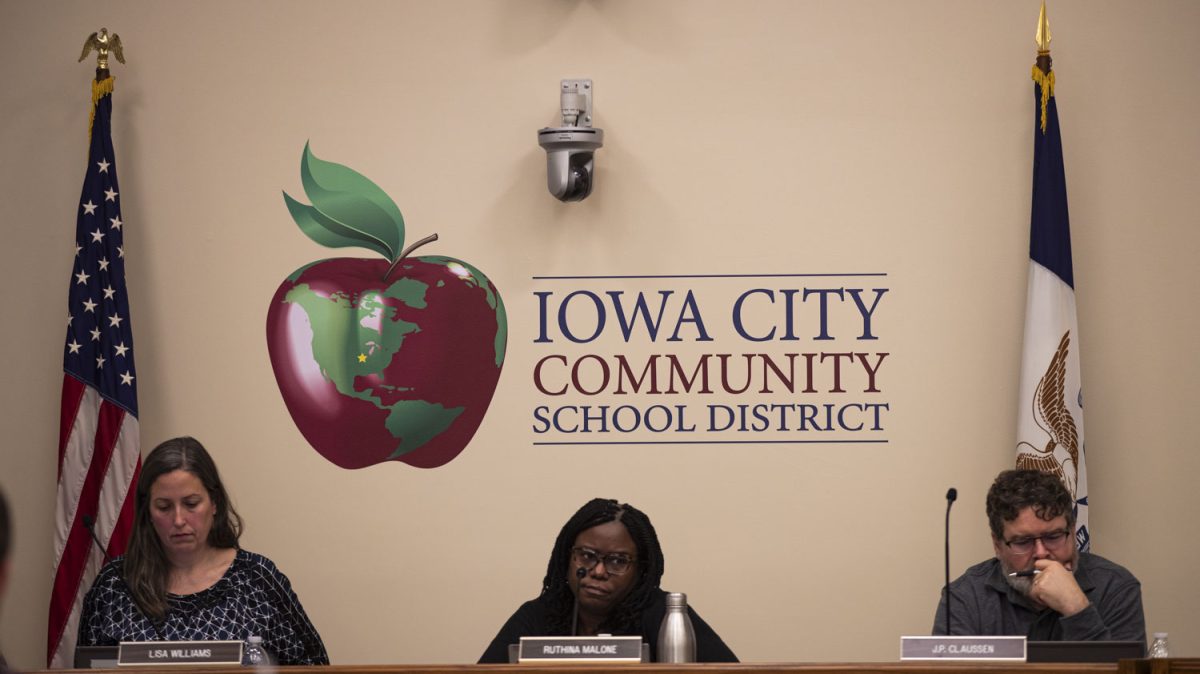

After initially drafting a certified budget that outlined a possible 15 percent increase in property taxes, Iowa City School District officials say there might be another place to scrape for revenue.

Instead of boosting the tax burden for area residents, school-infrastructure sales-tax funds could be used to fill budget gaps left by declining financial support from the state. Johnson County approved the 1 percent local-option sales tax increase in 2007.

The use of those funds, School Board member Sarah Swisher said, could decrease the need for a property-tax hike.

Paul Bobek, the district’s executive director of administrative services, updated the board on the preliminary certified budget for the 2010-11 school year. The plan calls for a 15 percent property-tax increase to compensate for fewer state-allocated dollars.

Board member Tuyet Dorau said she was hesitant to support a move that would rely too heavily on tax increases to boost revenue. She said it seemed too much like “robbing Peter to pay Paul.”

To counteract those increases, she suggested the board more comprehensively review general-fund spending and make efficiency cuts.

“I’m not convinced that we are being the most lean and efficient district we can be,” she said. “We’ve got to make sure we uncover every stone.”

But the board has already examined the general fund, Swisher said.

“I just don’t see where the resources are to cut any more and still deliver education at the quality that students in our district are used to receiving,” she said.

Especially in reviewing redistricting feedback, Swisher said, she felt resources covered by the general fund were particularly important to the community. She estimated approximately 50 percent of the e-mail messages sent to the district expressed concern that students shifting to different schools might lose essential resources.

But even if the board is able to trim the general fund further, Board President Patti Fields said, those trimmings will never equal the $12 million the district needs in revenue. Acknowledging that residents were struggling with the economic downturn, she stressed the need to prioritize.

Lack of solid data from the state level laced the board’s discussion with hypotheticals and uncertainties. Bobek said the financial support from the state might change by the time the district is scheduled to adopt the budget next month.

“We know that it’s not going to be able to finance all the state aid,” Bobek said. “The biggest challenge we have before us now is trying to estimate, how much that will be?”

Until those numbers have been released, he said, the district has given a high estimate of changes to be made. The board can approve a tax increase at or below the proposed rate.

On April 13, the district is set to conduct a public hearing on the issue, and it will certify and adopt the budget on the same day.