Iowa City and state officials expressed mixed reactions to Coralville’s recently downgraded bond rating.

Moody’s Investor Services dropped the city from a Triple-A bond rating to a Double-A rating, partially because of Coralville’s use of tax-increment financing — an economic tool that redistributes property taxes from the county and school district to a fund offered to potential developers. The city has received criticism from county officials for projects funded this way, such as absorbing most of the cost for Iowa City department store Von Maur to transfer to Coralville.

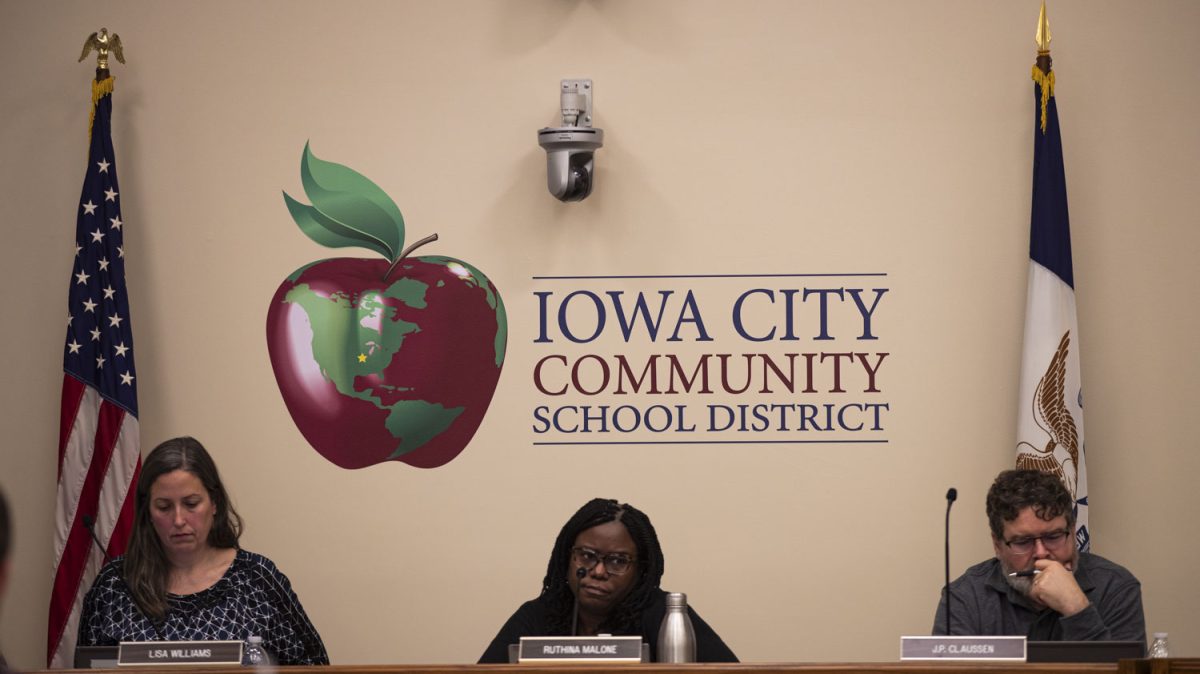

Johnson County Supervisor Rod Sullivan said Coralville’s downgrade will affect the rating the county receives for future bond sales.

"Our bond rating is reflective of the bond ratings of the institutions within the county," he said. "We benefit from the fact that Iowa City has a Triple-A rating, and it will hurt us that Coralville’s has been downgraded."

The county could potentially seek a bond to pay for the Justice Center project, which will be voted on by the public in the upcoming November election.

Sullivan said the ease of the bond sale will be determined by a variety of factors, one being the county’s bond rating. The county’s bond rating should be determined prior to the public vote.

However, Rep. Dave Jacoby, D-Coralville, said the downgrade was also a result of the city borrowing money for flood recovery following the switch in Iowa governors.

"The cities like Coralville are still hurting and recovering from the flood of ’08," he said. "During Gov. Culver’s term, the city received much more flood aid than it is currently receiving from Branstad. [Tax-increment financing] would be No. 1, but both of these pieces are significant."

Sullivan said he believes Coralville ignored concerns from the county and neighboring cities over the last 15 years about TIF creating competition between neighboring cities.

"We have tried over the years to explain that not only is some of this hurting other county residents, but it could be hurting them as well," Sullivan said. "It’s fallen on deaf ears, and I don’t think there’s any interest in frankly bringing it up, so what’s the point?"

Iowa City City Councilor Jim Throgmorton said Iowa City has tried to express concerns to Coralville the past, and the recent downgrade was not unexpected.

"We’ve expressed our concern about that in many different forms," he said. They’re very aware of our concerns."

However, Coralville Mayor Jim Fausett said he believes Coralville has been sensible in its use of the financing.

"I think we’ve been very well advised on our use of TIF, and we’ve used it very wisely," Fausett said, who will meet with the bond advisory committee in the coming weeks. "People I’ve talked to in Coralville are not unhappy with the way the city has grown, and what we’ve brought into the area. If you don’t do anything, you can have a great rating. If you want to get out and expand and better the city and bring in economic development, you have to spend money."

Jacoby agreed.

"I think they have [used TIF wisely] because of the number of high-paying jobs that have been created in the TIF district," he said. "I think what the county fails to do is take into account the number of jobs created."