Apartment owners now have the chance to get their property-tax bills cut in half following an Iowa Supreme Court decision allowing cooperative housing to be classified as residential.

And with many owners filing to change their status, the city and the county could lose up to $7.5 million in revenue, potentially forcing it to cut services in order to avoid raising taxes.

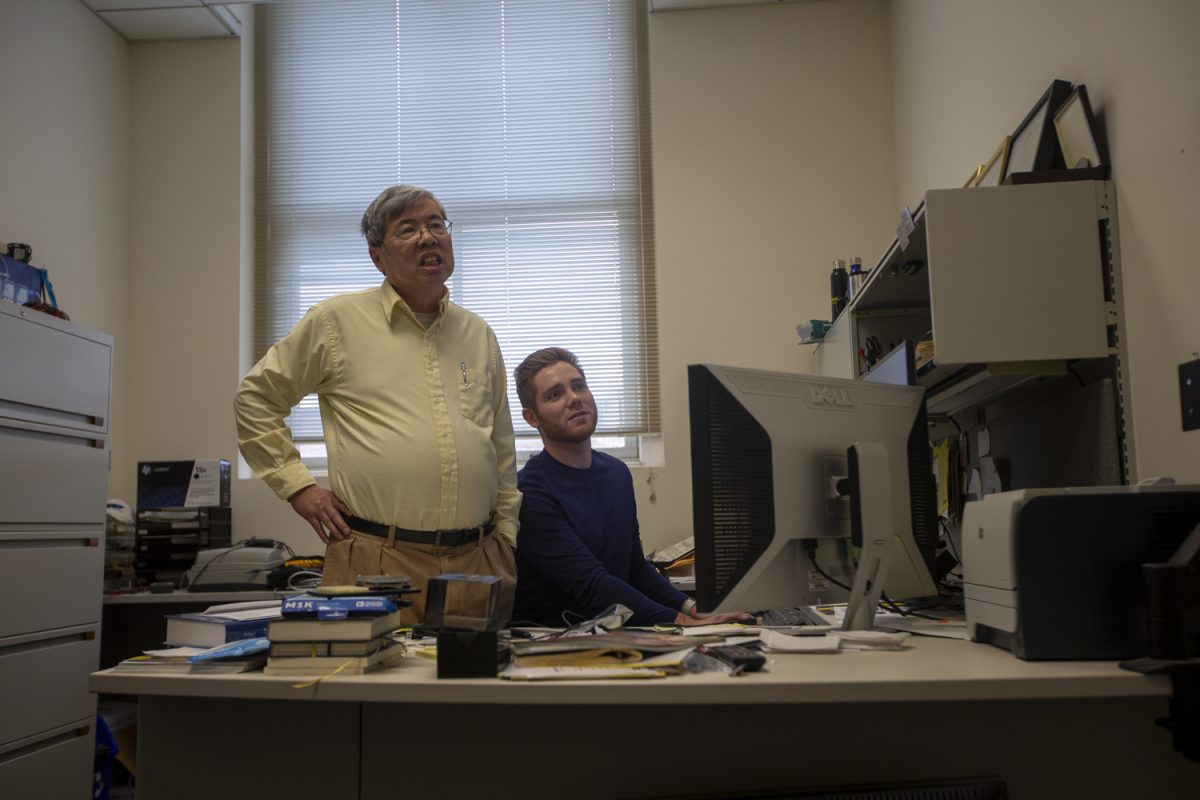

“My guess is departments would look at the core services they provide and see if they provide any extraneous services, and those would have to be eliminated,” said Kevin O’Malley, the city’s director of finance.

The change comes after a July 29 Iowa Supreme Court ruling in favor of two Iowa cooperative-housing units petitioning to pay residential versus commercial tax rate.

Apartments are classified as commercial buildings, said city assessor Dennis Baldridge. And when it comes to taxes, commercial buildings must pay 100 percent property taxes, whereas owners of residential buildings pay only half. As a result, apartments are now putting in requests to switch to co-op housing unit status in order to pay the less expensive residential tax rate.

“We expect a lot of them to switch over,” Baldridge said.

More than 10 years ago, many apartment buildings tried switching to condominium status in order to pay a lower tax rate, he said. However, condos must meet specific building codes, leaving many buildings unable to make the switch.

Apartments are able to change to co-op housing status without having to meet any additional building codes, making the option more appealing, he said.

“We expect more requests to happen in the future,” he said. “It’s become a concern to the cities and the county because it will mean tax losses for both.”

If every registered apartment building in Johnson County switched its classification by becoming a cooperative-housing building, local entities would lose $7,556,764, said Pat Harney, the chairman of the Johnson County Board of Supervisors.

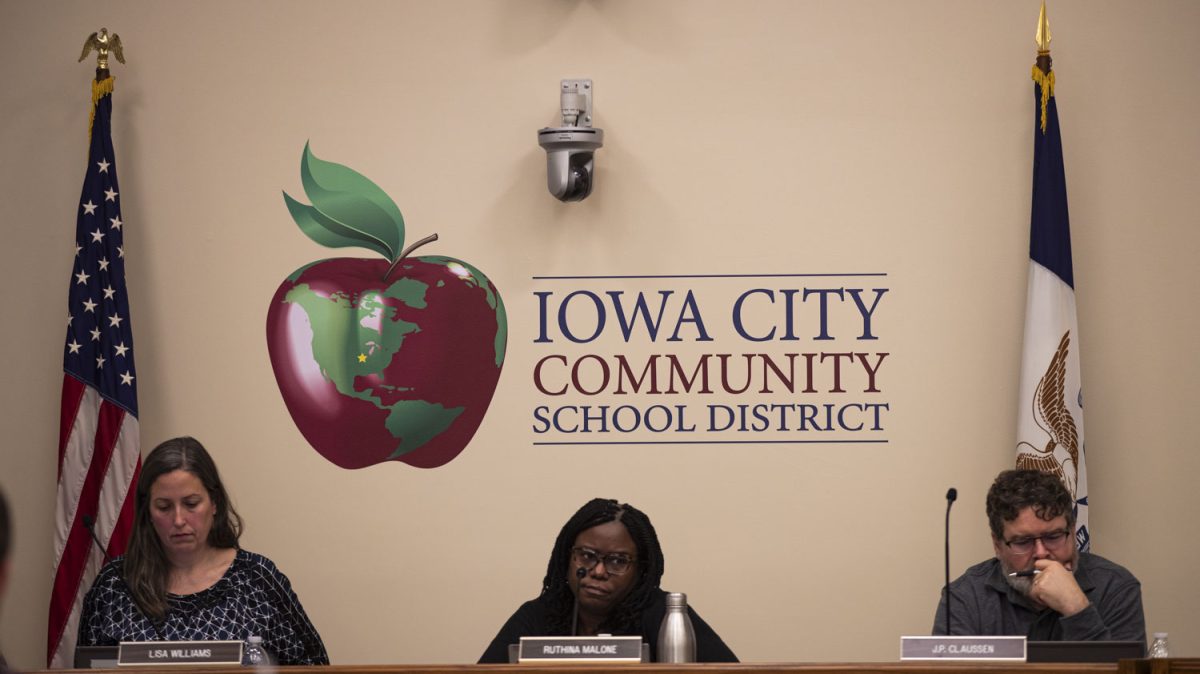

The City Council would lose more than 43 percent of that money — around $3,308,000 — and the Iowa City School District would face a decrease in revenue of $2,705,457, Baldridge said.

“I think it would be significant, and I think it would affect the budget significantly,” O’Malley said.

The city would face a 6.5 percent decrease in revenue if every apartment building turned into a co-op, he said.

O’Malley said he would be surprised if apartment tenants saw a reduction in rent.

“In my professional opinion, I agree a level playing field is how it should be for businesses, but I don’t believe that the apartment owners’ savings will be passed to tenants,” he said.

And officials hope this transition will happen gradually, in order to work with the new budget without immediate time constraints.

“I hope this happens in a slow fashion so that we can manage our way through this process,” O’Malley said.