After facing a needed $3.75 million budget reduction that led to the closure of Hills Elementary, the Iowa City Community School District also saw millions in losses from private school vouchers this year.

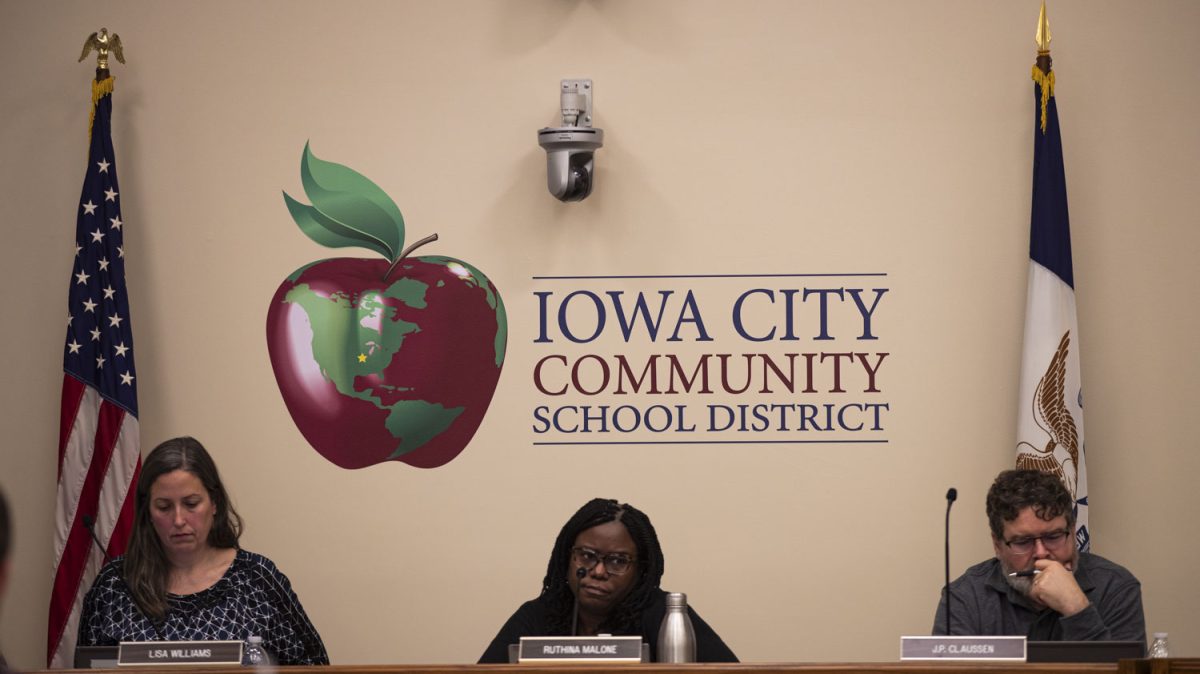

The district board of directors voted on Tuesday to approve its budget for fiscal 2025, which has declined since the previous year.

ICCSD’s total capital expenditures, including all funds such as construction and renovation costs, amount to $330,537,382. The total budgeted general fund is $200,698,751, which Chief Financial Officer Adam Kurth said is the current operating budget not including any debt payments or extra spending such as nutrition services.

The district lost $1.3 million in revenue due to private school vouchers, and nearly $2 million still needs to be cut since deciding to close Hills, which saved the district $1.6 million.

During the public hearing of the proposed fiscal 2025 budget at Tuesday’s meeting, board member Jayne Finch asked Kurth to explain increases in business and central administration costs, which are up nearly 33 percent from the last fiscal year.

Kurth said the increase affects all entities within the central administration, such as IT, human resources, and equity.

He said all decisions made regarding the management fund are driven by function codes determined by the state, and many of these function codes refer to district-wide programs, such as disability and workers’ compensation insurance.

Kurth also said multiple increases in the business and central admissions costs are tied to specific line items. For example, he said there was a $400,000 line item for the implementation of an enterprise resource planning solution, which he is unsure will be used at all this fiscal year.

“In case where we are going to spend lower than what we budgeted for, we don’t have an obligation for coming in below the amounts that we certified to go back and amend the budget, but it’s something that we can do and likely will do in our second meeting in May,” Kurth said.

Additionally, the district will see a 55-cent increase in the property tax rate from the current fiscal year increase after the tax rate was increased by $1.34 from fiscal 2023. The total utility replacement and property tax rate is $16.82 per $1,000 in taxable valuation, according to the fiscal 2025 budget.