Iowa senators attribute Silicon Valley Bank’s failure to bank, regulator mismanagement

Sen. Chuck Grassley and Joni Ernst said that the bank was engaging in risky behavior.

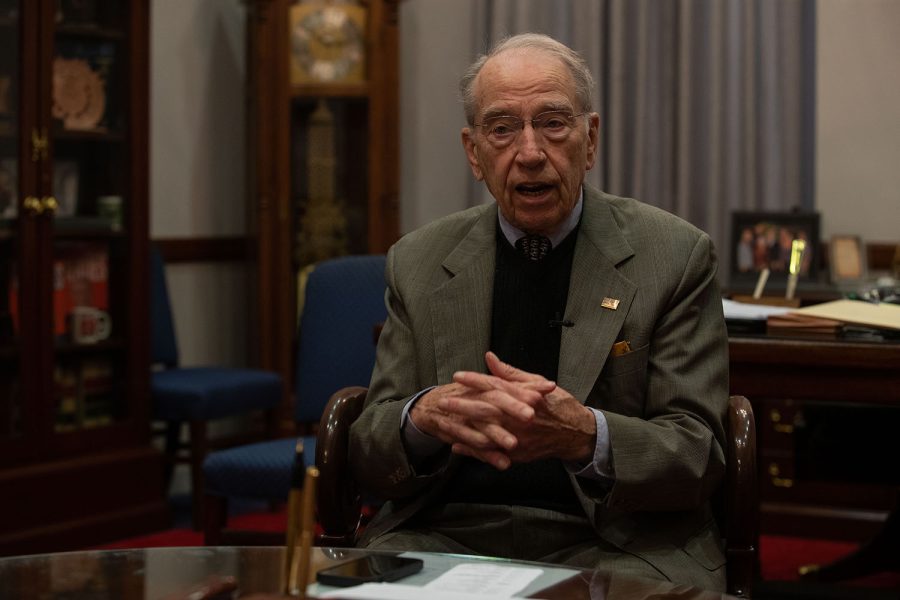

U.S. Sen. Chuck Grassley, R-Iowa, talks with “The Daily Iowan” in his office in the Hart building in Washington D.C. The DI sat down with Grassley to discuss recent state and local legislation.

March 28, 2023

WASHINGTON — Iowa’s senators don’t believe Congress needs to strengthen bank regulations following the fallout of the Silicon Valley Bank — at least for right now.

Sen. Chuck Grassley, R-Iowa, said in an interview with The Daily Iowan that Silicon Valley Bank’s problems stemmed from mismanagement by both the bank and regulators.

“I think that you look at what this bank did, having all of their capital in long-term government bonds or high-value mortgages that when the interest rate was going up by the Fed, and then the value of those go down,” Grassley said. “That the bank wasn’t on top of it, and the regulators weren’t on top of it, either.”

Silicon Valley Bank, a prominent lender for technology start-ups, collapsed on March 10. It was the second-largest bank failure in U.S. history behind the bank run that led to the failure of Washington Mutual in 2008.

The bank’s collapse raised questions on whether loose regulations on big banks are harming depositors.

President Joe Biden addressed the bank’s collapse on March 13 and called for of a “full accounting”of what led to the shutdown. But he also said he would ask Congress and the banking regulators to strengthen rules to prevent other failures from happening.

Banks, particularly small and medium-sized ones, didn’t always use to have lax oversight from federal institutions.

The Dodd-Frank Act, financial reform legislation from the Obama Administration, passed in July 2010 and strengthened oversight of all financial institutions.

But former President Donald Trump loosened regulations on small and medium-sized banks in 2018. The bill that was signed by Trump had passed Congress with bipartisan support.

One of the most notable changes was raising the threshold for tighter Federal oversight from $50 billion to $250 billion in assets.

Supporters of looser regulations said the move would help lift unnecessary burdens on smaller banks and allow them to compete with larger banks. Meanwhile, opponents argued that taxpayers could face more liability if a financial system collapses.

Grassley voted against the passage of the 2010 Dodd-Frank Act, which reformed financial regulations following the Great Recession, but supported deregulations under the Trump administration in 2018.

“The fallout of Dodd-Frank over the past decade was predictable and preventable,” Grassley said in a statement on March 22, 2018. “That’s why I voted against it. Significant parts of the law have been destructive for Iowa. I’m glad to have had the opportunity to vote in favor of important reform legislation that will help put things back on track for Iowa’s community banks.”

Grassley said he still stands by loosening these restrictions and only thinks Congress would need to act if there was a need to increase the $250,000 deposit insurance from the Federal Deposit Insurance Corporation.

The corporation, an independent agency of the U.S. government, currently insures $250,000 per depositor at FDIC-insured banks, but Biden said on March 25 that the administration would consider raising the total deposit insurance if other banks failed.

“I think the problems come because of bad bank management and because the regulators weren’t doing their job,” Grassley said.

Sen. Joni Ernst, R-Iowa, attributed the bank’s collapse to risky behavior.

“The regulators were not following those regulations with the Fed increasing their rates,” Ernst said in an interview with the DI. “They went into this knowing that only about 6 percent of the investment that went into that bank was insured 6 percent, which tells me right away that’s a bad business proposal right there.”

Ernst added that she doesn’t want to see any knee-jerk reactions to the bank’s failure and instead defer to the regulators.

“We need to hear from more people, what happened if there were bad behaviors and risky behaviors there, and if the regulators didn’t actually flag that risky behavior,” Ernst said.

Others like financial analysts and economists have speculated different reasons besides the bank’s mismanagement for the $1.8 billion loss.

University of Iowa economics professor Hennadige Thenuwara said other reasons contributing to the bank’s failure were economic factors such as the rise in interest rates.

Banks are risky businesses in general, Thenuwara said, because they depend on short-term money and invest in long-term assets. Banks have to be careful to prevent everyone from withdrawing their money at the same time.

“So usually, [banks] think that not all the people will come to the bank at the same time to take their money out,” Thenuwara said. “If that happens, no bank can survive.”

Because Silicon Valley Bank specialized in technology start-ups, the bank used to receive large deposits — but the FDIC can only cover up to $250,000. According to Time Magazine, 85 percent of the bank’s $175 billion in customer funds were uninsured.

Deposits are a liability for banks and need to be converted to assets, but a lack of diversity in those assets can harm the bank. Thenuwara said Silicon Valley Bank didn’t diversify its assets because it invested in too many long-term government bonds and did not loan out enough of its deposits or invest them in stocks.

Silicon Valley Bank purchased these bonds at high prices and when interest rates were low. As the Federal Reserve System raised interest rates throughout 2022 because of increasing inflation and other macroeconomic conditions, the value of the bonds purchased by the bank decreased.

The increase in interest rates meant that the technology startups were also less keen on seeking out loans, further preventing an inflow of cash into the bank.

Although there was initial concern over the stability of other banks, politicians such as Mariannette Miller-Meeks, R-Iowa, assured that banks are safe in a March 13 statement.

“American taxpayers deserve to have confidence in our financial system, and they shouldn’t be on the hook for the poor management of baking execs,” Miller-Meeks said in the statement. “Thankfully, our banks in Iowa are well capitalized and should be at minimal risk.”