When it comes to evaluating investment performance, investors and financial professionals rely on various metrics to gain insights into the effectiveness of their strategies. One such crucial measure is the money-weighted return, also known as the internal rate of return (IRR). This powerful tool provides a nuanced perspective on investment performance, taking into account the timing and size of cash flows.

What is Money-Weighted Return?

Money-weighted return is a method used to calculate the rate of return on an investment portfolio, considering the impact of cash inflows and outflows over time. Unlike time-weighted return, which focuses solely on the portfolio’s performance regardless of cash movements, money-weighted rate of return (MWRR) takes into account the timing and magnitude of cash flows. This approach provides a more accurate reflection of an investor’s actual experience, as it considers the impact of decisions to add or withdraw funds from the portfolio.

The Importance of Money-Weighted Return in Investment Analysis

Understanding the significance of money-weighted return is crucial for investors and financial professionals alike. This metric offers valuable insights into the true performance of an investment portfolio, considering the impact of investor behavior and market timing. By incorporating cash flows into the calculation, money-weighted return provides a more realistic assessment of an investor’s actual returns. This information is particularly valuable when evaluating the performance of actively managed portfolios, where the timing of investments and withdrawals can significantly impact overall returns.

Calculating Money-Weighted Return: Methods and Formulas

The calculation of money-weighted return involves complex mathematical formulas and iterative processes. While the exact calculations can be intricate, understanding the basic principles is essential for investors and financial professionals. The most common method for calculating money-weighted return is through the use of the internal rate of return (IRR) formula. This approach determines the rate of return that equates the present value of all cash inflows to the present value of all cash outflows.

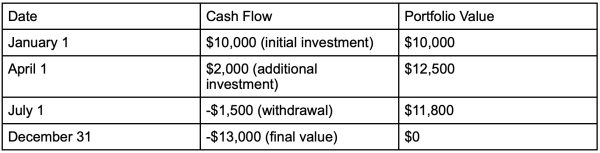

To illustrate the concept, let’s consider a simplified example:

In this example, the money-weighted return would be the rate that satisfies the equation: 10,000 + 2,000/(1+r)^0.25 – 1,500/(1+r)^0.5 – 13,000/(1+r) = 0, where r is the money-weighted return. Solving this equation would yield the annual money-weighted return for the investment.

Money-Weighted Return vs. Time-Weighted Return: Key Differences

While both money-weighted return and time-weighted return are important performance metrics, they serve different purposes and provide distinct insights. Time-weighted return focuses on the performance of the investment itself, eliminating the impact of cash flows. This makes it ideal for evaluating the performance of investment managers or comparing different investment strategies. On the other hand, money-weighted return considers the impact of cash flows, making it more suitable for assessing an individual investor’s actual experience and the effects of their investment decisions.

Consider a scenario where an investor makes a significant contribution to their portfolio just before a market downturn. In this case, the time-weighted return might show positive performance for the overall period, while the money-weighted return would likely be lower, reflecting the unfortunate timing of the large investment. Understanding these differences is crucial for investors and financial advisors when interpreting performance data and making informed decisions.

Practical Applications of Money-Weighted Return in Financial Planning

Money-weighted return finds numerous applications in financial planning and investment management. Financial advisors often use this metric to provide clients with a more accurate picture of their investment performance, taking into account the timing of contributions and withdrawals. This information can be particularly valuable when assessing the impact of regular savings plans or retirement withdrawals on overall portfolio performance.

In the realm of private equity and venture capital, money-weighted return is frequently used to evaluate fund performance. These investments often involve irregular cash flows and varying holding periods, making money-weighted return a more appropriate measure than time-weighted return. Additionally, real estate investors can benefit from using money-weighted return to assess the performance of property investments, considering the impact of rental income, property improvements, and refinancing activities.

Limitations and Considerations of Money-Weighted Return

While money-weighted return provides valuable insights, it’s important to recognize its limitations and potential drawbacks. One key consideration is that money-weighted return can be heavily influenced by the timing and size of cash flows, potentially leading to misleading results in certain scenarios. For instance, a large contribution made just before a significant market rally could result in an inflated money-weighted return that doesn’t accurately reflect the underlying investment performance.

Another limitation is the complexity of calculating money-weighted return, especially for portfolios with frequent or irregular cash flows. This can make it challenging for individual investors to compute and interpret the results without specialized software or professional assistance. Additionally, money-weighted return may not be suitable for comparing the performance of different portfolios or investment managers, as it incorporates the impact of investor-specific cash flow decisions.

Integrating Money-Weighted Return into Investment Decision-Making

To make the most of money-weighted return in investment decision-making, it’s essential to consider it alongside other performance metrics and contextual information. Investors and financial professionals should use money-weighted return in conjunction with time-weighted return, risk-adjusted measures, and benchmark comparisons to gain a comprehensive understanding of investment performance. By analyzing these metrics together, investors can make more informed decisions about portfolio allocations, contribution strategies, and withdrawal plans.

Furthermore, it’s crucial to consider the time horizon when interpreting money-weighted returns. Short-term results can be heavily influenced by recent cash flows, potentially leading to misleading conclusions. Therefore, it’s generally advisable to focus on longer-term money-weighted returns when assessing overall investment performance and making strategic decisions.