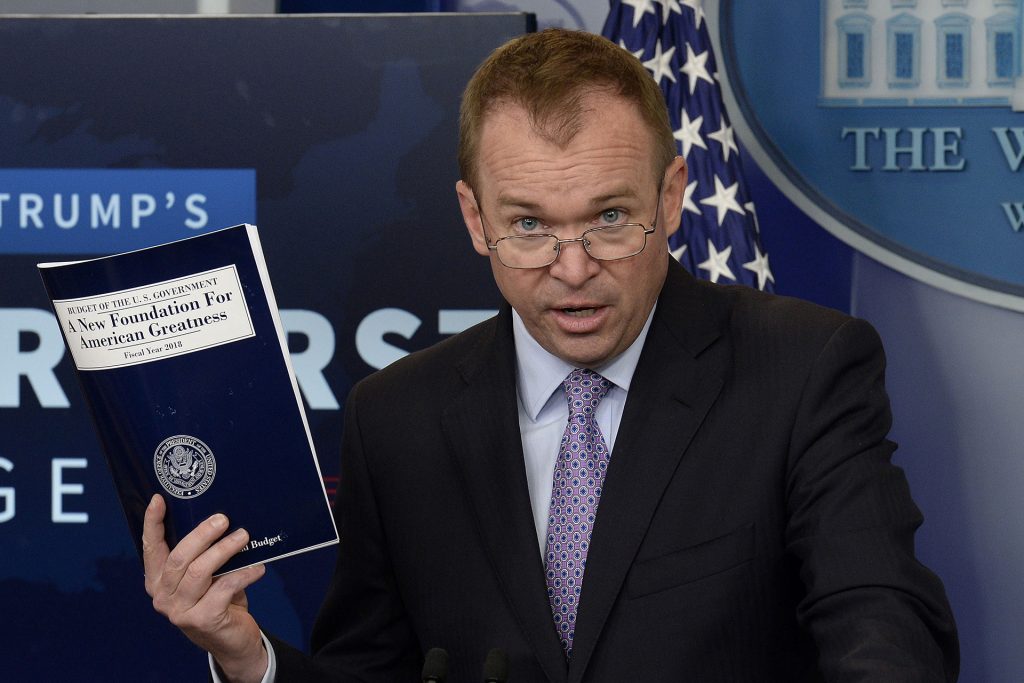

Trump appointed Mick Mulvaney to be the acting head of the consumer agency, but he faces a harder decision in the coming months with both republicans and voters breathing down his neck.

By Lucee Laursen

Recently, two government officials fought over who was going to be the director of the Consumer Financial Protection Bureau. On Nov. 27, both Mick Mulvaney and Leandra English told employees of the agency that they were the new acting director. Mulvaney is a Trump appointee after former Director Richard Cordray resigned, and English was appointed by Cordray to serve until a permanent director was nominated and OK’d by the Senate.

On Nov. 29, federal Judge Timothy Kelly decided that Mulvaney would be the acting director of the agency.

Trump’s decision to appoint Mulvaney contradicts the Republican Party’s agenda to drastically change or end the agency but promotes his “drain the swamp” agenda. Ultimately, Trump has both his voters and Republican Party leaders breathing down his neck.

The consumer agency is responsible for consumer protection in the financial sector. The creation of this agency came after the 2008 housing crisis and recession. Its main purpose is to enforce federal consumer-protection laws.

For years, Republicans have criticized the agency for having too much reach. Many have called for a complete overhaul of the agency to restrict its power. Sen. Ted Cruz and House Speaker Paul Ryan are just a few of the Republican Party leaders who have voiced their displeasure with the agency.

But over the years, Republicans have changed their narrative, making it obvious that their goal is to defund and ultimately shut down the agency. The most recent claim, or theory, was given by Rep. Jeb Hensarling, who said, “… one-third of all blacks and Hispanics [will] no longer be able to buy homes that they have traditionally been able to buy.” Hensarling is referring to regulations that the agency has put on big banks, forcing them to conduct comprehensive background checks before approving people for loans. Big banks dislike this because they now are unable to approve as many loans as they could pre-2008, which means less money in their hands.

What this regulation really tries to do is ensure consumers can actually pay back their mortgages before they sign the dotted line. Which means, yes, some people will be turned away from taking out large loans. This is to prevent subprime loans.

But both Hensarling and Cruz want voters to believe they are looking out for the public — more specifically, Hensarling wants minorities to believe he is looking out for them. But they are doing quite the opposite. They are attempting to tear down an agency that hurts their deep-pocketed supporters: big banks. This is clear cronyism, and it is exactly what Trump campaigned against.

The Nov. 27 fiasco over dueling directors at the agency has cast a bright light on the agency itself.

The nation can now watch exactly what Trump will do. This is not his first opportunity to prove that he really will drain the swamp, but it is an important turning point for our president. In only eight months, Trump will be faced with appointing a permanent director to the agency.

I believe that in order to stay connected with his voter base, Trump must keep the agency afloat. Choosing to appoint Mulvaney, or anyone for that matter, is a sign that Trump does not plan to ax the agency. Of course, the agency will most likely see some changes in a new administration, but it will still be operational. I hope that Trump takes the time to understand how this will affect not only his reputation but the American people as a whole.