A recently reached trade deal on Mexican sugar exports to the U.S. avoided repercussions that could have adversely affected Iowa’s corn industry or Iowa’s trade relationship with Mexico.

Negotiations were opened in response to accusations by the U.S. sugar industry that contended Mexico was dumping inexpensive sugar on the United States market, making it impossible for domestic sugar producers to keep their prices competitive.

Fearing increased tariffs and trade restrictions on sugar exported to the U.S., Mexico had previously threatened to retaliate by placing its own duties on U.S. exports of high-fructose corn syrup.

Although Iowa does not export high-fructose corn syrup to Mexico, the country still remains Iowa’s second-largest foreign market thanks to trade involving corn and soybeans.

In a May 1 letter to U.S. Secretary of Commerce Wilbur Ross, Sen. Chuck Grassley, R-Iowa, urged Ross to “resolve the U.S.-Mexico sugar dispute in a way that keeps all consequences and impacts contained to those directly involved in the dispute” rather than affecting other U.S. trade interests such as corn or high-fructose corn syrup.

“A lack of resolution in these negotiations could have significant implications for U.S. interests beyond the petitioners and the sugar industry and could affect jobs and farmers in my home state of Iowa and across the U.S.,” wrote Sen. Joni Ernst, R-Iowa, in a May 18 letter to Ross.

Ernst and Grassley both released statements praising the negotiation’s outcome following its conclusion.

“This is great news for U.S. jobs, industry, and agriculture,” said a June 6 press release by Grassley’s office. “Avoiding a trade war will benefit everyone, and I’m glad that this years-long dispute is finally reaching its end. Getting a better and fairer deal for Americans while avoiding retaliatory actions by foreign governments is no easy task.”

Although high-fructose corn syrup is a substitute for cane sugar, Iowa State University economics Professor Sebastian Pouliot said Iowa’s corn producers are unlikely to be affected by any market fluctuations as a result of the Mexican sugar agreement.

“The corn prices vary daily,” he said. “The variations that happen in the day are probably larger than what this would cause.”

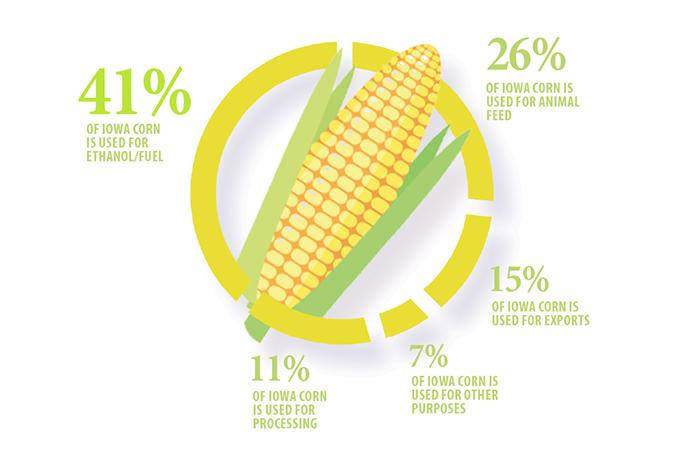

For one thing, Iowa is insulated because most of its corn becomes feed or goes to producing ethanol. According to the Iowa Corn Growers Association, corn processing accounted for only 12 percent of Iowa’s corn use during the 2014-15 marketing year.

Pouliot said the corn that goes into the production of high-fructose corn syrup is less than 5 percent of all the corn in the U.S.

Iowa may not be heavily involved in the high-fructose corn syrup industry, but the corn refiners that have plants located in Iowa and purchase a significant portion of Iowa corn are.

Ingredion, Cargill, and ADM — three of the four major U.S. corn refiners that make up the Corn Refiners Association — have plants located in Iowa.

“We produce no sweeteners at the Cedar Rapids plant,” said Claire Regan, the director of communications at Ingredion, in a June 20 email to The Daily Iowan.

However, Regan said, essentially all corn processed at the plant is grown within a 100-mile radius of Cedar Rapids.

“We don’t give exact amounts for competitive reasons, but the Cedar Rapids plant uses tens of millions of bushels of corn per year,” she said.

According to information provided by Christina Martin, the executive vice president of the Corn Refiners Association, in 2014, the corn-refining industry purchased 1.55 billion bushels of Iowan corn, equaling a farm value of $6.9 billion.

Although corn refining is not Iowa’s biggest market, the effect on Iowa’s economy would not be small if the corn-refining industry were to take a hit.

Gregg Nuessly, the executive director of the Everglades Research and Education Center at the University of Florida, said the deal’s effect on the sugar industry will depend on follow-through and enforcement.

“If it still doesn’t give local industry the power to block the illegal dumping … then it’s going to hurt the U.S. market,” Nuessly said.

For now, many in the sugar industry remain unhappy with the new sugar deal. However, renegotiations of NAFTA — which could begin as early as mid-August — may present the industry with another opportunity.

President Trump, who has repeatedly expressed his own dissatisfaction with NAFTA’s treatment of the United States, said he will get rid of the trade agreement altogether, but Nuessly said the U.S. handling of the sugar deal indicates that the administration may not be so heavy-handed.

“This is the first thing that shows me that they’re thinking long-term and they’re thinking about compromise, not just my way or the highway,” he said. “[The U.S.] can upset the balance in ways that can last awhile by pushing too hard in one direction. People just go someplace else to buy or sell. That can have pretty dramatic effects.”

Nuessly said if push came to shove, Mexico could potentially ramp up its corn production.

“When you think about where corn was grown and where it came from, it came from Mexico … and they can grow it all year round in certain areas,” Nuessly said.