Minimum-wage fight hits home

February 16, 2017

Students working through college may soon become more reliant on other sources of income to pay tuition.

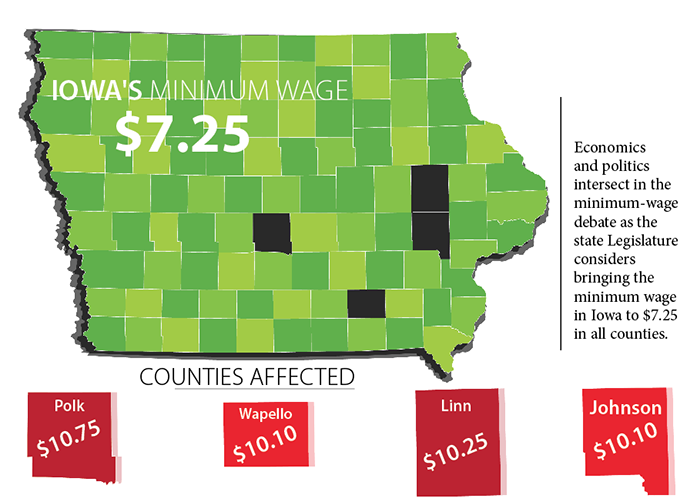

A bill introduced by Rep. Jake Highfill, R-Johnston, in the Iowa House Local Government Committee would affect such counties as Johnson County, where the minimum wage is $10.10, higher than the federal minimum wage.

Highfill did not respond to Daily Iowan* requests for comment this week.

The legislation would bring the minimum wages of all counties in Iowa back to $7.25, stating that “a county shall not adopt, enforce, or otherwise administer an ordinance, motion, resolution, or amendment providing for any terms or conditions of employment that exceed or conflict with the requirements of federal or state law relating to but not limited to a minimum or living wage rate,” among other employment matters.

Rep. Art Staed, D-Cedar Rapids, a ranking member of the Local Government Committee, said in a republic such as the United States, local governments should have the power to set their own wages if they wish.

“It pre-empts all the wage increases where our families compete for jobs and people for good positions … and taking it down to $7.25, that takes the state out of the competition,” he said.

University of Iowa economics Professor John Solow said the minimum-wage debate is more a question of politics than economics, essentially coming down to whether society is willing to help the poor. He said a minimum wage of $7.25 doesn’t allow people to spend the same amount of money it once did.

In regards to college students, Solow said the student-loan debt problem can be attributed more to the privatization of higher education and the fraudulence of for-profit colleges rather than inadequate minimum wages.

“The payoff [of getting a college degree] is high, and it’s worth incurring [debt],” he said. “The extra income that you make because you have a college degree and you get a better job and a more high-paying job and you move up the ladder in your career faster, that is enough to pay off that.”

Having different minimum wages on the federal level, state level, and local levels has been effective because it reflects the fact that there are different labor markets across the United States, and wage distribution varies in other regions, said Ben Zipperer, an economist with the Economic Policy Institute. He said lowering that wage could be harmful for many reasons, one of them being significant living costs.

“Many years ago, it used to be possible to earn something like the minimum wage and be able to pay for your college expenses,” he said. “Now, that’s not the case both because of rising tuition and because the minimum wage hasn’t kept up with the pace of the economy.”

UI student Pearl Vick, an employee at Union Station, said living expenses are especially a concern for her. She receives financial aid from the UI, but she doesn’t receive financial assistance from her parents, so the money she makes by working goes toward rent, groceries, and other living expenses. Several of Vick’s coworkers are in similar situations, she said.

“I work a lot of morning shifts and … it really cuts into time that I would spend studying for school, because it means I have go to bed a lot earlier,” she said. “It’s already difficult to try to find the time to get all of my schoolwork done or the time to put as much effort as I would like to put into my college work.”

If the state were to lower minimum wages, Vick said, she could see it affecting students’ financial stability in the future.

“If you’re having difficulty making ends meet now, you can’t really save for the future and save for when your student loans are going to start becoming due,” she said.