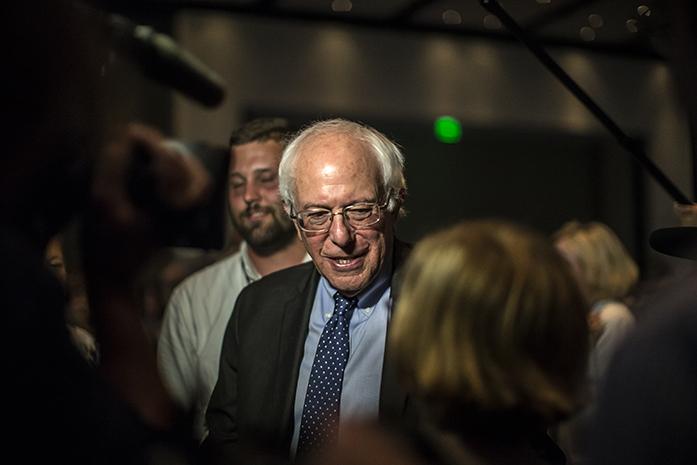

Just hours before the Democratic presidential debate on Sunday, Sen. Bernie Sanders, I-Vt., released his plan for universal health care provided by the U.S. government. The plan, which relies heavily on increased taxes and decreased costs from the medical supply and pharmaceutical industries, would drastically alter health care in the United States.

While the Daily Iowan Editorial Board believes that Sanders’ plan is optimistic and beneficial, there are flaws that make the proposal more idealistic than realistic. The prospect that medical supply and pharmaceutical companies would readily decrease the costs of their products is unlikely (as shown by the precedent set through Obama’s “public-option” proposal). Moreover, Sanders’ plan features staggering increases in a variety of taxes, many of which would be met with staunch opposition from conservatives.

According to the Huffington Post, experts “figured the public option could dictate lower payment rates to suppliers and providers of medical care, just like Medicare does, thereby keeping premiums low and forcing private insurers to match them.”

But as the article goes on to explain, despite support from voters in polls and various experts, the “public-option” bill was met with opposition from pharmaceutical companies and doctors fearing it would cut into their revenue. By the time Democrats got the bill to a point at which it could pass, the public option had little chance to cut the cost of pharmaceuticals anyway. Given that these cuts are such a large component of Sanders’ proposal, it is unlikely that the plan could work if these rate decreases aren’t achieved.

The other component of Sanders’ plan includes tax increases, such as a 6.2 percent payroll tax paid by employers and an increase in income taxes paid by families making more than $250,000 a year, going up to 52 percent for those making more than $10 million.

According to Monticello.org, Thomas Jefferson never said, “The democracy will cease to exist when you take away from those who are willing to work and give to those who would not.” Which means that people who call upon this quotation for support in arguing against raising taxes for the wealthy are grasping at straws.

However, Jefferson did say something similar: “To take from one, because it is thought that his own industry … has acquired too much, in order to spare to others, who … have not exercised equal industry and skill, is to violate arbitrarily the first principle of association — the guarantee to every one of a free exercise of his industry & the fruits acquired by it.”

To say that universal health care is taking money from the hardworking and giving it to the “not-hardworking” is a stretch. However, Jefferson’s comments bring up the debate of whether health care is a right (and subsequently if individuals should have to work for their health care).

The discussion of health care as a right is far beyond the scope of this editorial, but it is a point of contention in the Republican-controlled Congress. So if Sanders hopes to pass a bill that has individuals earning more than $10 million a year paying the majority of their salary in taxes, Democrats will have to regain control of Congress or he will have to do something even more difficult, persuade the other side that health care is a right.