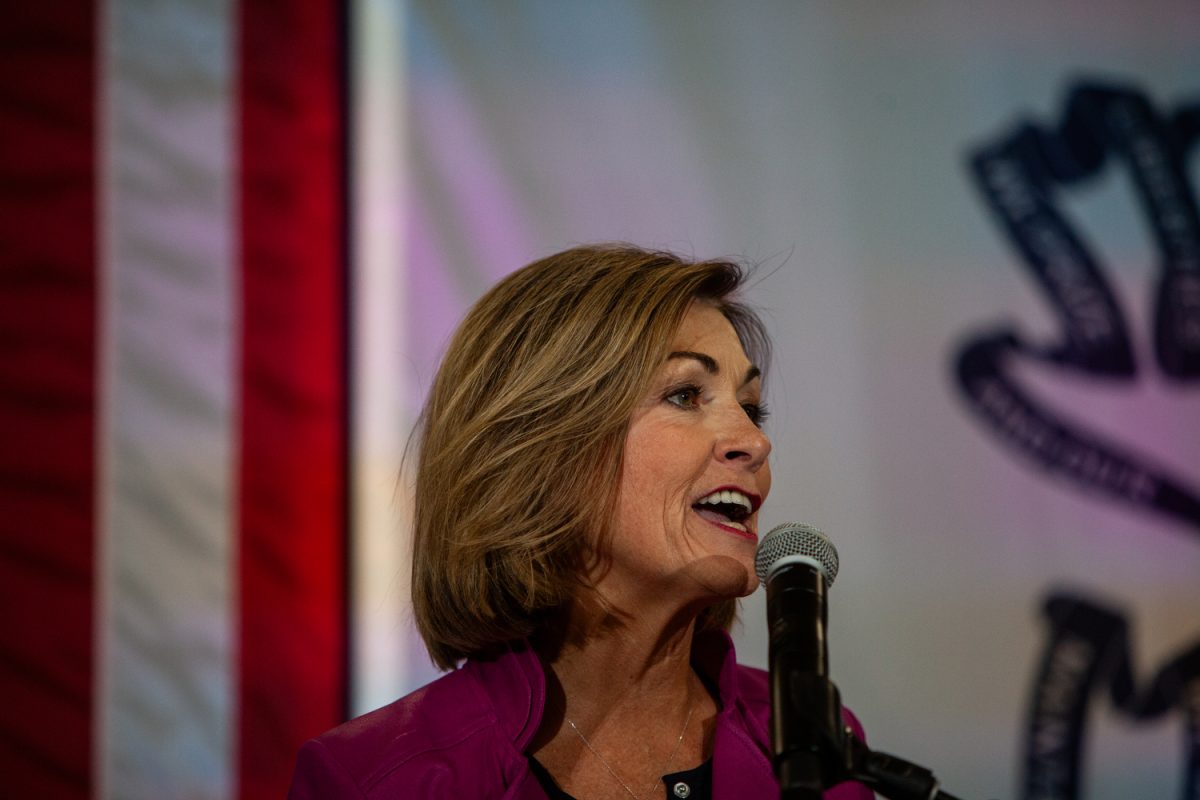

Iowa Senate lawmakers advanced Iowa Gov. Kim Reynolds’ proposal to accelerate cuts to the state income tax on Monday.

Senate Study Bill 3038 would accelerate the income tax cut signed into law in 2022. The 2022 tax cut would make income taxes in the state a flat 3.9 percent for all Iowans by the 2026 tax season.

Under the bill, the income tax rate for 2024 would be 3.65 percent — retroactive to the beginning of this year — and would be a flat 3.5 percent by the beginning in 2025.

The bill advanced out of subcommittee, 2-1, and is now eligible for consideration in front of the Senate Ways and Means Committee with a recommendation for amendment. Senate Minority Leader Pam Jochum, D-Dubuque, opposed the bill.

Molly Severn, the governor’s legislative liaison, cited the state’s $1.83 billion general fund surplus, $902 million surplus in reserve funds, and $2.74 billion in the state’s Taxpayer Relief Fund when addressing legislators during a subcommittee hearing on the bill Monday afternoon.

“The state is over-collecting from Iowans, and they deserve to keep more of their hard-earned money,” Severn said to lawmakers on Monday.

An analysis by Common Good Iowa, a progressive think tank that advocates for children and families in Iowa, found the state’s surplus was inflated by federal dollars infused into the economy and driving revenues all around the state. However, the analysis found that the surplus could see massive changes when the economy isn’t doing as well in the future.

“We can push the pain off because of those surpluses but the thing about one time money is that when it’s gone, it is gone,” Anne Discher, the executive director of Common Good Iowa, said during the hearing on the bill.

Jochum opposed the bill in the subcommittee and said the tax cuts give more of a tax break to wealthy Iowans than working class Iowans.

“The bottom line is that the people who most need a tax break are the middle and working-class families,” Jochum said.

The analysis by Common Good Iowa also found two-thirds of the benefit of the governor’s proposed tax cuts would go to Iowans who earn more than $1 million a year. The analysis found that those who make over $1 million a year would pay $30,401 less in taxes in 2025 and those who make less than $20,000 a year would only see a $34 reduction in taxes owed.

Sen. Jason Schultz, R-Schleswig, said he was supportive of the governor’s plan and looked forward to cutting taxes for Iowans.

“I’m always going to be supportive of looking for ways to leave money in the pockets of the people’s pockets who earned it,” Schultz said. “We have very good conservative long range revenue plans in place, making sure that we won’t get in trouble down the road.”

The analysis also found the tax cuts would cause the state to lose $1.7 billion in revenue in 2024, and $1.8 billion in 2025, slashing the state’s surplus in half by 2025.

“I would hope that we’re going to slow this down and really spend a lot of time dissecting it and really understanding the long-term impact this is going to have on our state in the years to come,” Jochum said.

The bill would also reduce the amount the state holds in the Unemployment Trust Fund, which is used to pay unemployment claims and is required by federal law. The governor’s office expects it to cut unemployment taxes by 40 percent and to save employers $800 million over five years.

Peter Hird, a lobbyist with the Iowa Federation of Labor, said they are concerned about the effects that reducing the amount in the Unemployment Trust Fund could have on Iowa workers seeking unemployment, especially if there is a recession.

RELATED: Iowa lawmakers pin tax reform, cost reduction as top priorities for 2024

“We did survive the threat of a recession over the last few years, but it happens every once in a while,” Hird said. “And we want to make sure the workers of Iowa are protected during that time.”

The bill would also make child care facilities a subcategory of commercial property that would allow them to be taxed at residential property tax rates saving the centers money.

Daniel Stalder, a lobbyist with the League of Cities, said they are waiting for a fiscal analysis by the nonpartisan legislative services agency on the bill to see how it would affect property tax income for local governments.

The chair of the Ways and Means Committee, Sen. Dan Dawson, R-Council Bluffs, introduced two bills to separate the childcare facility property tax division of the bill and the unemployment tax reform from the main bill.