Gov. Kim Reynolds signs flat tax rate into Iowa law

Iowans will eventually pay 3.9 percent in income tax, marking a win for Reynolds and Republicans’ priorities.

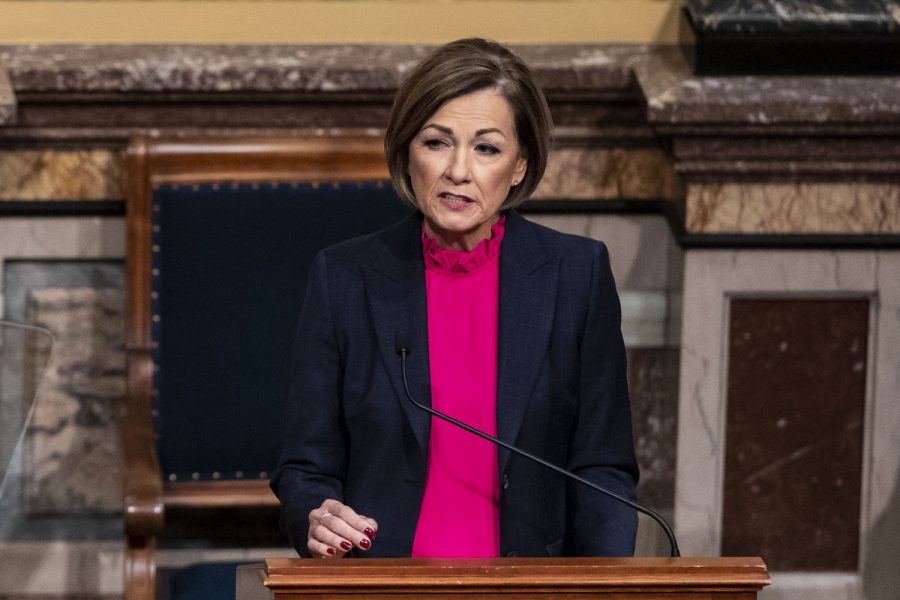

Iowa Governor Kim Reynolds delivers the Condition of the State address at the Iowa State Capitol in Des Moines, Iowa, on Tuesday, Jan. 11, 2022.

March 1, 2022

Gov. Kim Reynolds signed a bill that would eventually apply a flat tax rate of 3.9 percent for Iowa taxpayers into law on Tuesday.

“This bill rewards work, takes care of our farmers, and supports our retirees, all while protecting key state priorities. Iowans will reinvest these dollars in our economy, communities will prosper, and families will rest a little easier. Once again, we’re putting our faith in Iowans, and they won’t let us down,” Reynolds said in a press release shared on Tuesday.

In a press release, Senate Majority Leader Jack Whitver, R-Ankeny, said this bill is the third major tax cut package that the Senate has passed in four years. The other tax cuts Reynolds has signed into law happened in 2018 and 2021.

Once House File 2317 is fully implemented, Whitver’s release said, Iowa’s individual income rate will go from being the eighth highest in the nation, to the fourth lowest at a flat rate of 3.9 percent.

“A nearly $1.9 billion tax cut creates an environment for more career opportunities for Iowans, gives Iowans more of an incentive to rejoin the workforce, and helps Iowans weather the impact of record setting inflation created by the reckless policies coming from Washington, DC,” Whitver said in the press release.

The law will gradually lower the top income tax rate, and a flat tax of 3.9 percent will take effect in 2026.

A flat tax system applies the same rate to all taxpayers regardless of income.

The bill would exempt all pension and retirement income from state taxes, provide relief for retired farmers through tax deductions and reduce corporate income tax with yearly adjustments until they reach the flat tax rate of 5.5 percent, as long as corporate taxes bring in a certain amount every year.

Sen. Dan Dawson, R-Council Bluffs, said in a press release from Senate Republicans that cutting Iowa’s tax rates to a flat tax is a huge step toward getting rid of income tax in Iowa completely and that the bill will benefit Iowans and their families greatly.

“Today is truly a great day to be an Iowan,” Dawson said. “We’ve heard the quote ‘Big government bureaucrats believe every day is April 15 and Senate Republicans believe every day is the Fourth of July,’ and today feels like the Fourth of July as we celebrate this accomplishment of transformational tax relief for Iowa families.”

HF 2317 passed the House in a vote of 61-34 and passed in the Senate in a vote of 32-16 on Feb. 24.

Of Johnson County legislators, Sen. Kevin Kinney, D-Oxford, and Rep. Bobby Kaufmann, R-Wilton, voted in favor of the bill. Sens. Joe Bolkcom, D-Iowa City, and Zach Wahls, D-Coralville, and Reps. Mary Mascher, D-Iowa City, Amy Neilson, D-North Liberty, Dave Jacoby, D-Coralville all voted in opposition to the bill. Rep. Christina Bohannan, D-Iowa City, abstained or was absent from the vote.

Though the legislation got a few Democratic votes, the Iowa Democratic Party said in a press release that the tax cut leaves Iowa families behind because a flat tax rate isn’t fair.

Ross Wilburn, Iowa Democratic Party Chair and Iowa House Representative for District 46, said that the Republicans tax plan benefits the wealthiest Iowans and called it a “reckless corporate tax giveaway” at the expense of lower-income Iowans and public services.

“The Democratic plan would have provided relief by investing in workers, families and small businesses, who need financial relief more than the super-wealthy,” Wilburn said.

At her Condition of the State address at the beginning of the legislative session in January, Gov. Kim Reynolds highlighted the flat tax rate as one of her biggest priorities for this year.

Reynolds celebrated the law’s passage in a press release on Tuesday, saying when she took office in 2017, Iowa had the sixth highest tax rate in the country at 8.98 percent.

“I believed Iowans deserved better. Since then, I’ve worked with the legislature across multiple sessions to make transformative changes to our tax code, let Iowans keep more of their hard-earned money and make our state more competitive,” Reynolds said in the press release.

The singing also comes just hours before Reynolds will be in the national spotlight, delivering the Republican response to President Joe Biden’s State of the Union address Tuesday night.

On Feb. 24, Reynolds tweeted her support of the bill and how it “accelerates the momentum” that the Republican party has been building to cut tax rates in Iowa.

Reynolds signed the bill into law in a signing ceremony Tuesday afternoon. She said that beginning in fiscal 2023, the tax liability for nearly 295,000 Iowa taxpayers will be eliminated under the retirement provision of this new tax law and 98 percent of Iowa taxpayers with $10,000 or more of taxable income will see a decrease in total taxes due by fiscal 2026.

Rep. Lee Hein, R-Monticello, the bill’s floor manager, said during his floor remarks that the legislation would make Iowa’s economy stronger.

“We said the tax plan would cut taxes for all Iowans. We said that if we were going to lower the corporate rate, we were also going to reform corporate tax credits. We said that we were going to eliminate taxes on retirement income so that more folks can continue to call Iowa home after they retire. Well, folks. Promises made, promises kept,” Hein said.

Iowa Democrats proposed their own tax plan in February, that would have provided $300 million to fund public schools and incentivize apprenticeship opportunities. This plan did not make it to the floor in either chamber.

After Reynolds signed the bill, the Iowa Democratic Party sent out another press release criticizing the tax plan. Wilburn said in the press release that he expects this tax policy to fail Iowans.

“Kim Reynolds’ agenda rewards her corporate donors, not hardworking Iowans. Under this reckless plan, she’s handing millionaires an extra $1200 a week, while teachers and truck drivers get less than $12 a week,” Wilburn said.