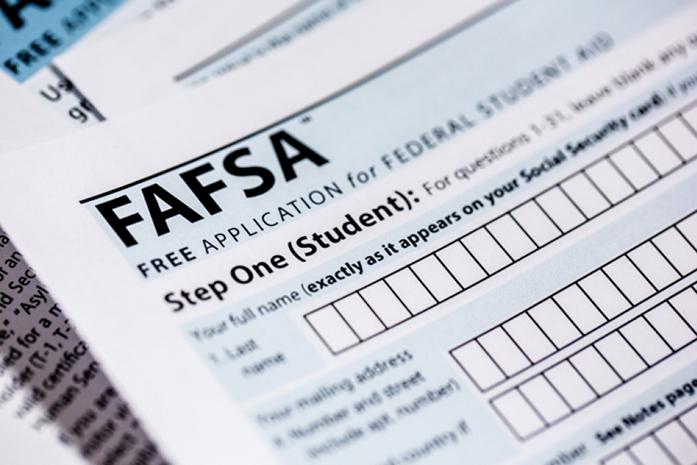

While university-owned bookstores have been exempted from charging students sales tax on items, legislation in the Iowa House aims to open this exemption to private retailers.

“There’s been some back-and-forth over the years about whether [sales tax] should be collected, whether it is being collected, and I believe that as tuition costs continue to rise that textbooks should not be taxed as a small benefit to the students that are trying to get by,” said the bill’s House floor manager, Rep. Bobby Kaufmann, R-Wilton.

The bill, which is still being formed, House File 2486, was introduced April 11 in the Ways and Means Committee and put on the committee’s calendar. If passed, it would provide a sales-tax exemption for private retailers in the sale of instructional materials required for courses at postsecondary institutions when purchased by students enrolled in the courses.

RELATED: Student leaders urge legislators, administrators to consider holistic cost of being a student

Kaufmann said he has received positive feedback and widespread bipartisan support for the proposal; it was passed unanimously by the Ways and Means Committee two weeks ago.

The bill could help private retailers who at present must charge sales tax on course materials.

“It would be a level playing field in terms of pricing,” said Virgil Hare, the textbook manager for Iowa Book. “[Students] would see, at least online, the prices are the same, and they’re going get get charged that as opposed to the 6 percent added.”

Beginning in 2017, Iowa State University and the University of Iowa no longer charged sales tax on textbooks, required instructional materials, and school supplies. The University of Northern Iowa will follow suit no later than July after the university purchased the UNI Bookstore from University Book and Supply Inc. in March.

RELATED: Textbook case: No sales tax

Hare said he noticed a difference in customers but cannot directly attribute it to the UI Hawk Shop’s change in sales tax, noting that most students did not bring this up.

While he supports textbooks having a sales-tax exemption, he said he does not agree with university-owned bookstores including other items as tax-free.

In March, the Cedar Rapids Gazette reported revenue from nontaxable sales at the UI was greater than $31.6 million. The Hawk Shop, located in the IMU, sells course materials as well as apparel and home decor.

According to a fiscal note from the Legislative Services Agency published April 19, the sales-tax exemption provided by this bill would have an effect on the general fund, the Secure and Advanced Vision for Education Fund, and local option sales tax.

Agency analyst Kenneth Ohms described the secure-education fund as the “sixth cent” of the 6 percent sales tax in Iowa. The fund pays for school-district infrastructure and property-tax relief.

RELATED: Lane: Textbooks becoming (expensive) dinosaurs

The general fund could see at least an approximate $1.91 million loss in fiscal 2019, which would drop by fiscal 2023 to at least approximately $1.80 million. The other two funds would also see losses around $381,000 and $301,000, respectively, in fiscal 2019.

“The general-revenue-stream total is like $7 billion, and sales tax itself is the second-largest revenue stream,” Ohms said.

According to the legislative agency, the average spending per student on required instruction materials for the 2016-17 academic year totaled $579.The agency gathered the data from a report from the National Association of College Stores. Because of the variance among state sales-tax rates and policies, Ohms said he is working from the assumption sales tax was not already calculated into this total. Using that average spending per student with the state sales tax of 6 percent, an average student would have paid $34.74 in sales tax, bringing the total cost to $613.74.

Kaufmann believes the exemption would be a wise investment in college students.

“So is it a hit to the budget?” he said. “Sure, but I think that’s a hit worth taking when you’re providing tax relief to students who will save some money.”